The Poor Man’s Covered Call Strategy is probably one of the most underutilized strategies in the options world. This wonderful strategy allows you to generate income similar to regular covered calls but without the large capital required to own 100 shares of the underlying stock.

If you don’t have the funds to purchase the full 100 shares, the PMCC strategy comes to the rescue. You can substantially grow a small account using the poor man’s covered call strategy. With the proper guidance, PMCCs can become an integral component of your options trading portfolio.

In this article, we will dive into the step-by-step process for implementing poor man’s covered calls to your benefit. You’ll learn how to establish PMCC positions to maximize income potential and account growth. Even if you’re just a beginner in options trading and starting out with limited capital after going through the complete article you will have enough knowledge to start executing the PMCC strategy.

We’ll walk through real examples of constructing efficient trades using this strategy. So without further ado, let’s get started on learning the essentials of the poor man’s covered call strategy.

What is a Poor Man’s Covered Call Strategy?

The Poor Man’s Covered Call Strategy is an options strategy that essentially combines a covered call with a LEAP or very similar to the LEAP. In a PMCC Strategy, you are not required to own 100 shares of the stock as the collateral, unlike the traditional covered call. Instead, you can buy a deep ITM ( In The Money) call option which is far out in the future at least 90+ DTE ( Date to Expiry). And Then you start selling covered calls which are OTM ( Out of the Money) against the deep ITM money option.

PMCC vs Traditional Covered Call

Unlike a traditional covered call where you must hold 100 shares of the underlying stock to sell calls against, there is no such requirement with the poor man’s covered call strategy. The key benefit of the PMCC Strategy is not needing to own the full 100 shares to generate income from covered calls. This significantly reduces the capital investment required.

Since you don’t have to tie up capital buying 100 shares of stock, PMCC provides greater leverage over your invested dollars. Rather than owning just one stock, you can establish PMCC positions on multiple names with the same amount of capital.

However, one disadvantage of Poor Man’s Covered Call Strategy compared to traditional covered calls is that you would be missing out on potential dividend payments. Because you are not actually holding the shares, you do not receive the dividends you’d get from owning the stock outright. But I believe that capital leverage and income-generating potential often outweigh the lack of dividends for many traders.

How To Setup A Poor Man’s Covered Call

There are two steps to setting up a PMCC.

- Step 1: Purchase a long-dated LEAP call option that is deep in the money, with a delta around 0.90, and has an expiration date far out in the future (usually 1+ years). This establishes the long leg.

- Step 2: Sell short-term out-of-the-money call options against the LEAP. These short calls generate income but have an expiration date much sooner than the LEAP (typically under 60 days). The short calls are the other leg of the PMCC.

Let’s take an example of AMD stock and see how you can set this up in the Robinhood platform. You may set this similarly to any other brokerage platform of your choice.

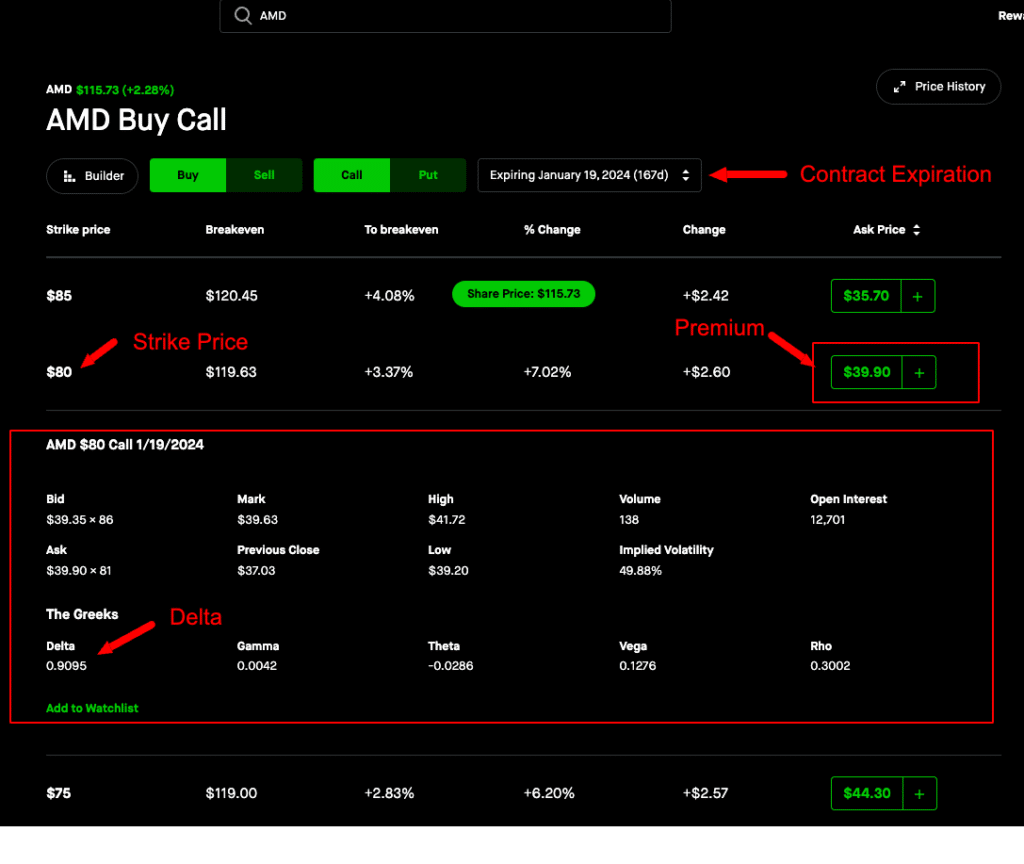

To start, we will buy a deep-in-the-money call option on AMD with a far-out expiration date. Looking at the options chain for AMD, we see the current stock price is around $115. To choose a deep ITM call with a delta close to 90, we select the $80 strike price fitting that criteria. The expiration date we pick is January 2024, which is far out in the future, satisfying the long-term requirement.

For this long call option at the $80 strike expiring January 2024, we have to pay a premium of approximately $3,990. Buying this LEAP call option establishes the first leg of the poor man’s covered call trade. It provides us control of 100 shares of AMD without needing to lay out the capital to purchase the full 100 shares for $11,500. We’ve now initiated the long side of our PMCC position.

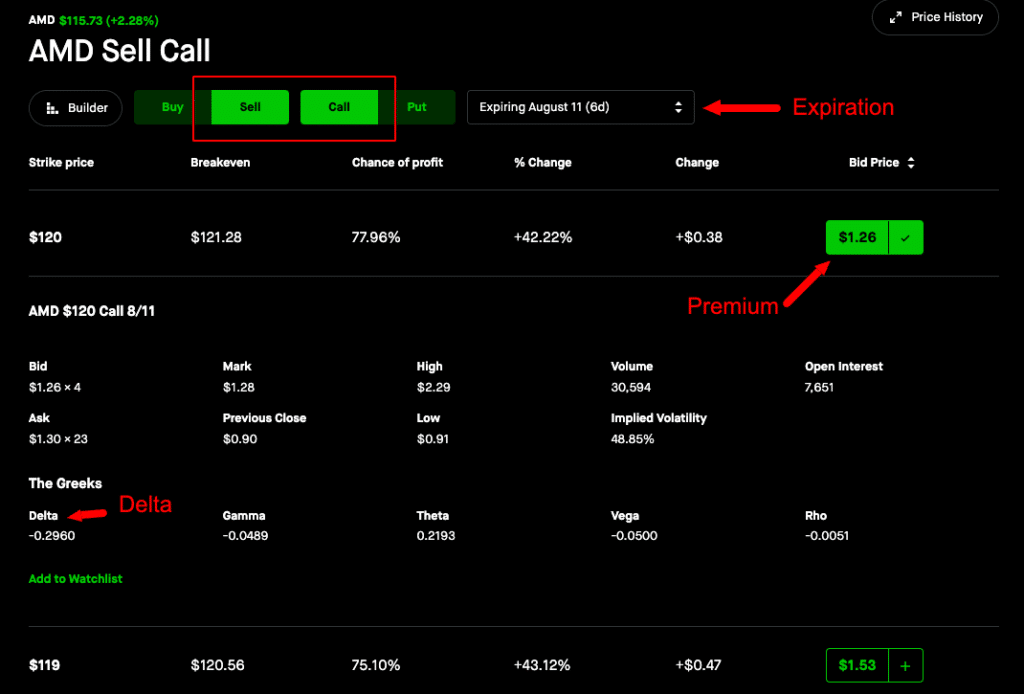

The next step is to sell an out-of-the-money short-call option against our long LEAP, using a nearer-term expiration date. We will choose an expiration just one week out, in August 2023, to create the short side of the PMCC structure. Scanning the August options chain, we select a strike price of $120, which is out-of-the-money compared to the current AMD share price of around $115.

Selling this $120 call option expiring in August generates a credit or premium of approximately $126 for us. Collecting this premium income from the short call is the second leg of constructing our poor man’s covered call position. We now have established the long LEAP call, and short weekly $120 call against it, completing our PMCC trade on AMD.

To summarize, the total debit required to open this poor man’s covered call trade on AMD is $3,990 (the cost of the long LEAP call) – $126 (the credit from the short call) which equals $3,864. Compared to buying 100 shares of AMD outright at the current market price of around $115, which would cost $11,500, constructing this PMCC position allows us to control the same 100 shares for almost 3 times less capital.

The PMCC Strategy provides the same upside exposure and income potential as regular covered calls but at a significantly lower cash requirement upfront. This example demonstrates the power of the poor man’s covered call strategy for efficiently allocating capital while generating consistent income.

You may use the remaining capital to open another position on the same stock or different stock to multifold your profits and that is exactly how PMCC provides leverage over your money.

Max Profit / Loss For Poor Man’s Covered Call

Let us understand our max loss and max gain for the PMCC strategy.

Maximum Profit – PMCC

The maximum profit for a poor man’s covered call position is similar to a bull call spread, calculated as the width of the strike prices minus the net debit paid. Using our AMD example, the difference between the strikes is $12000 – $8,000 = $4000. Subtracting our net debit of $3,864 gives a theoretical max profit of $4000 – $3,864 = $136.

However, in practice with PMCC Strategy, the goal is often to have the short call expire worthless while holding the LEAP to continue selling additional covered calls. By rolling the position and repeatedly collecting premiums from new short calls, the profit potential is not truly capped.

Also Read

As long as you can keep selling short-term calls against your long LEAP, profits can accumulate over time so there is no fixed max profit in this case. The key is to continue managing the position by selecting favorable strike prices to have the short calls expire OTM.

Maximum Loss – PMCC

The maximum loss for a poor man’s covered call trade is equal to the net debit or total cost to enter the position. In our AMD example above, the total cost was $3,864 to establish the PMCC trade. Therefore, the maximum loss is capped at $3,864.

This loss would occur if AMD stock ends up finishing below our long LEAP call option strike price of $80 at the expiration of both the long and short calls. In this worst case, the long $80 LEAP call would expire worthless, while we still incurred the initial $3,864 debit to put on the PMCC position.

How To Select Stock For PMCC Strategy

As a beginner, selecting the right stocks can be tricky when implementing poor man’s covered call trades. Below are the two key principles that you should be looking for when selecting stock for PMCC.

Based on these criteria, some of the best stocks for PMCC are large, stable companies with a track record of long-term upward trajectory. Analyzing mega-cap names like AAPL, SPY, JNJ, and MSFT can identify candidates with healthy long-term trends. The goal is to choose established stocks poised for continued gains over time.

One critical factor is avoiding high-volatility stocks with frequent large swings. Sudden sharp movements can negatively impact the PMCC position, requiring constant adjustments. Instead, target steady, predictable growers for the long LEAP call. Slow and steady gains are best for this strategy, not lottery tickets. With the right stock selection focused on long-term progress, beginners can find much better success in executing PMCC Strategy.

How To Select Strike Price for PMCC

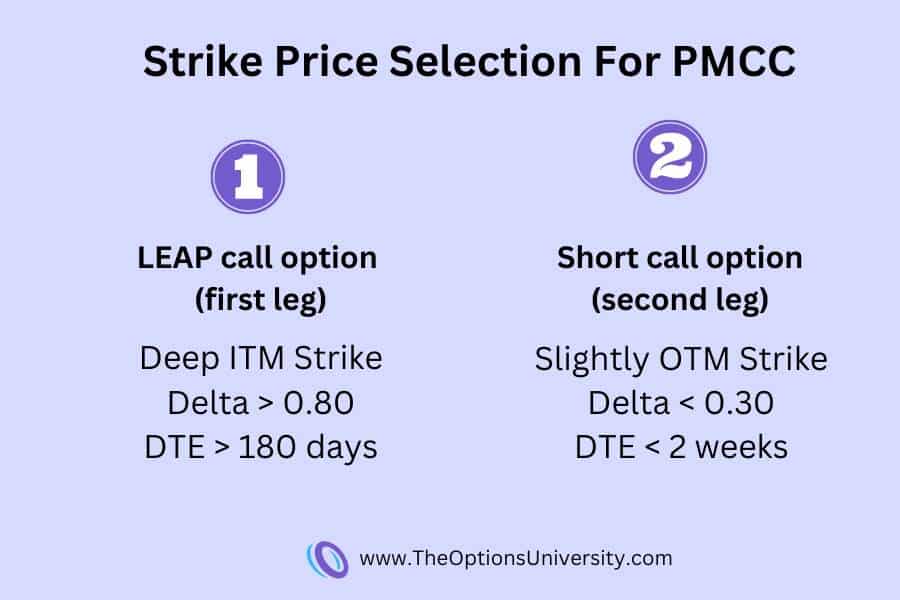

It is very important for selecting the right strike prices for both legs in a Poor Man’s Covered Call position. A ballpark guideline for this goes as below.

Let’s understand the rationale behind choosing strikes in this manner. For the long LEAP call, we target deep in the money with a delta of around 0.90. This gives the option a large intrinsic value and little extrinsic value or time premium.

We want minimal time decay on the LEAP, as it has a longer expiry. Deep ITM fits this goal, as there is minimal extrinsic value to erode over time. The high delta also provides nearly a 1:1 exposure to the underlying stock price.

For the short call, we select an out-of-the-money strike with a delta under 0.30. This means picking a strike noticeably above the current stock price, giving a decent buffer for the stock to rise before breaching the short strike.

Also, using a nearer-term expiry for the short call allows us to benefit from rapid time decay as the contract approaches expiration. We strategically craft the long and short strikes to construct an efficient PMCC position that potentially profits on both intrinsic value and time decay.

How To Close Poor Man’s Covered Call Trade

To close the PMCC position you can simply do the reverse of what you did to open it which means you buy back the short covered call position and then sell the long deep ITM call option. Both can be done in a single transaction.

Or you may close only the short call position and keep the long LEAP option open that is what the typical cycle looks like in a PMCC strategy. you keep closing the short call and opening new ones for further DTE.

Common Mistakes

While PMCC trades do have defined risk capped at the net debit paid, it’s important to avoid some common errors when establishing the position.

One mistake is entering the PMCC at an inefficient cost basis. As a general rule, the difference between the long and short strike prices should exceed the entry cost.

Looking again at our AMD example, the spread between the $120 short call strike and the $80 long call strike was $4,000. This exceeded our net debit of $3,864 to enter the trade. Having a wider spread cushion helps manage early assignments.

If the stock is called away at the short strike before expiration, the long call can be sold to generate a profit and offset some losses. But if the entry cost is too high relative to the spread, early assignments can quickly lead to losses.

Another error to avoid is improperly selecting strike prices that don’t follow the recommended guidelines. You should always carefully choose strikes that align with the PMCC strategy principles. Never get greedy with strike selection.

For example, some traders may be tempted to use a nearer-term expiration for the long LEAP call in order to minimize the capital requirement. However, picking a shorter expiry can backfire due to higher extrinsic value and accelerated time decay.

Even though a shorter dated call costs less upfront, there is more extrinsic premium baked into the price that theta will rapidly erode. This can turn an otherwise profitable PMCC into a losing position. Stick to long-dated expiries beyond at least 6+ Months to a year for the LEAP call.

Risk Management for PMCC

It’s crucial to manage risk properly when trading PMCCs. There are three main scenarios to plan for:

Short call expires OTM

This is the goal. You let the short call expire worthless and can then sell another short call at a later expiry, repeating the cycle. The long LEAP call may not need adjustment.

Short Call ITM with Time

You can potentially stay in the trade as extrinsic value erodes, hoping for the stock to move back to OTM by expiration. No early assignment risk exists while extrinsic value remains.

Short Call ITM with No Time

This is the key risk scenario requiring action. If the stock has risen significantly and the short call is ITM with minimal extrinsic value left close to expiry, the early assignment becomes a real danger.

In scenario three, you must proactively manage the position before expiration to avoid assignment. You have the option to roll up the short call open to either modify the strike price or you can change the DTE ( Date to Expiry) to give it more time to play out.

Another important factor to watch out for is the upcoming dividend for the stock. There is always a high chance for an early assignment during the week of dividends. To mitigate that you can actively check for the ex-dividend date week and skip setting up the short call during that week to avoid early assignments.

Overall, carefully managing trades around options expiration dates is crucial for reducing risks associated with Poor Man’s Covered Call Strategy.

Pros and Cons of PMCC

Here are some key Pros and Cons that you will have to watch out for when working with Poor Man’s Covered Call Strategy.

Pros

- Premium paid upfront

- The premium money could be invested elsewhere to make additional profit

- Theta decay works in your favor in a neutral movement

- Getting paid to own a stock at your desired price

Cons

- Upside potential is capped

- Early assignment risk on short call

- Adjustment may be required rapid stock movement

- Unrealized capital loss if stock falls after assignment

FAQ

Poor Man’s Covered Call is an options strategy that combines a long LEAP leg and a short call leg to essentially form a diagonal spread. This is called a poor man’s covered call as it provides leverage over the capital to generate consistent income similar to outright owning stocks.

The poor man’s covered call (PMCC) strategy does carry some inherent risks, primarily from sudden stock price movements and early assignment. However, PMCCs can generally be traded relatively safely through the use of proper risk management tactics.

Yes PMCC is a wonderful strategy specifically if you have a small account. It provides leverage over your money to generate consistent income similar to a traditional covered call but without actually the need for owning the stock.

When executed correctly, the poor man’s covered call strategy has the potential to generate substantial profits and quickly grow a small trading account. By carefully managing the entry cost basis, strike price selection, and overall trade risks, PMCC can provide an excellent way to build account value over time.

Final Thoughts

For anyone starting out with limited capital and looking to steadily grow their account, the Poor Man’s Covered Call Strategy can prove to be a powerful options strategy. As we have covered in this article, PMCC strategy provide an efficient way to generate consistent income without tying up large amounts of cash. However, as we discussed, proper risk management when executing PMCC trades is absolutely crucial to ensure success.

Hope you liked the article and gained valuable insights from this. If you have any further questions or comments please feel free to put them below or you may email us at [email protected].