In this article, we are going to discuss everything related to options, think of this as Trading Options 101 focused entirely on keeping a beginner in mind. We will look at what it really takes to trade options, and how to make consistent weekly/monthly income trading options.

What are the real risks of trading options and how to successfully mitigate those risks? So if you are interested to learn about options then read through as we will explore options in full detail in this article. So let’s dive straight into it.

Myths About Options

So you would have probably heard that the options are way too risky and it is not for beginners or it requires a large Capital so on and so forth. In this section, we are going to bust that myth for you.

We will go Point by point and look at what are the myths and what are the real facts about options

The first one you would have probably heard is that options are way too risky and it is in fact true but it depends on how you play the options. If you just buy a bunch of calls in the hope of stock moving in your direction then you have a full chance of failure.

Your account could wipe out as well but on the other hand let me tell you that option is not risky and as we go more into this article you will understand some very safe strategies that people use to generate consistent income better than stocks

This may be partially true but let me be clear that options are not different than any stock and the more you learn about options and the strategies around them, you will find that in fact options are way simpler than people make them to be.

It just requires some patience and sticking to the basics and believe me you will never go back to any other derivatives in the market.

Again not true, options do not require a large sum of capital, in fact, there are some very safe strategies out there like put/call credit spread or put/call debit spread which require a very small capital. These strategies are meant to grow small accounts multifold and in a very safe and consistent manner.

As mentioned in the complex point that it may have a slight learning curve compared to simple buy/sell of stock but that does not anyway mean that it is not for beginners. In fact, you can start implementing simple strategies on options with little to no time.

I am going to explain all the basics here and hopefully, by the end of this article, you will be ready to do some paper trading using options.

Facts About Options

Now let’s look at some of the actual facts that make options one of the most attractive derivatives that exist in the market today.

Higher Returns

Options have a much higher potential for returns compared to stock trading. You can easily make 10-100x more from options with way less capital. But do note that strategies that are linked to getting higher returns from options like buying a call or buying a put often comes with more associated.

Higher Priced Stocks

Unlike typical stock trading where if you do not have much capital to start with you cannot even think of trading higher-priced stocks. This is not true with options, it provides you the ability to trade on higher priced stocks like NVDA, COST, WMT, etc with very less capital.

Passive Income

This is probably one of the best reasons why everyone should trade options. It allows you to consistently generate a weekly/monthly income almost passively.

Diversification

Most beginners in the stock market only think about stock trading and options give you that diversification in your portfolio using various options strategies.

Hedging

This is one of the best benefits you can leverage from options. You can hedge your portfolio against any sudden market moves so that you are covered against any big losses. In fact, options such as hedging are used by most of the big investment firms and investors including warren buffet. For example, you can buy a put position to hedge yourself against a downturn in the market.

Flexibility

Options trading provides you the flexibility of time you do not really have to be glued down to your computer screens if you play the correct options strategies. For example, by selling/buying call or put options you can either play weekly or monthly or even yearly strategies with it. You just need to spend a couple of hours a week/month.

What Are Options?

According to Investopedia, the definition of an option is “Options are financial derivatives that give buyers the right, but not the obligation, to buy or sell an underlying asset at an agreed-upon price and date.”

Let’s try to break it down and take an analogy from a real-world example to simplify this and make it easier to understand.

We will start with a story of two friends Tom and Jerry. Jerry owns a condo that Tom is looking to purchase as he is expecting that a big IT company is planning to set up their office near that area and the prices for those condominiums are expected to rise multifold in the next 1 month.

However, he is a little skeptical that if this company’s plan changes and they don’t move into this area the prices may not go up at all or worst can go down as well. So what should Tom do in this situation?

As far as Jerry is concerned he is willing to sell the condo no matter what as he requires the money. Tom comes up with an agreement that he believes will prove to be a win-win for both of them. Here is what that agreement states:

- Tom pays an upfront nonrefundable fee of $10,000 today.

- Jerry agrees to sell the land to Tom after 1 month if he agrees to enter into this contract

- The price of the sale( which is expected 1 month later) is fixed today at $100K

- Because Tom has paid an upfront fee, only he can call off the deal at the end of 1 month (if he wants to that is), Jerry cannot

- In the event Tom calls off the deal at the end of 1 month, Jerry gets to keep the upfront fee of $10,000

So what do you think is smarter here is it Tom who has cleverly put in this agreement or is it Jerry who gets to profit after all? The answer is not that simple as there are many things that can go in either direction. Before we dive into the three outcomes of this deal let’s try to break down the detail of this agreement to understand it better.

- By paying an upfront fee of $5000 Tom is binding Jerry into this obligation and forcing him to lock the property for him for the next 1 month.

- Tom has fixed the price of the condo as per today’s market rate which is $100k. And irrespective of whatever happens 1 month from now Jerry is obligated to sell the property to him.

- At the end of 1 month if Tom does not want to buy the condo he can choose to do so however Jerry is obligated to sell if Tom wants to buy it.

Ok, hope you are with the story so far, now is the interesting part about the possible income and their repercussions to both these parties.

Possible Scenarios

Based on this use case there are three possible scenarios.

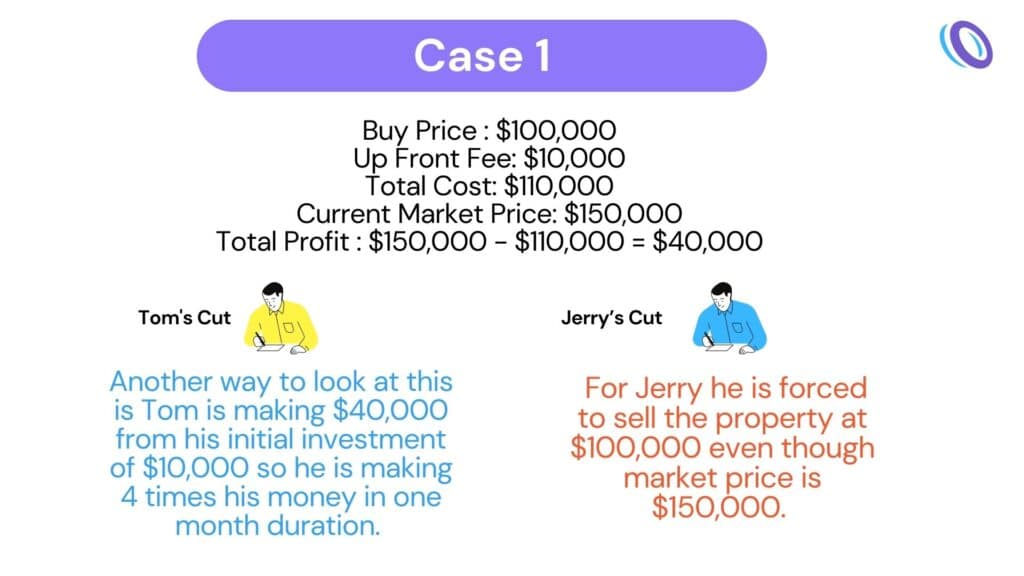

Case 1

Let’s start with the positive outcome from Tom’s perspective. The company indeed sets up their new office and the condo appreciates its value and goes to $150K. As you remember as per the agreement Tom has the right to buy this condo at a total price of only $100K even though the current market price has gone up to $150K. So this case has clearly gone in Tom’s favor so how much Tom would actually make from this deal?

Case 2

Now let’s take the case if the price just stays flat it neither goes up nor down. After one month the condo price still stands at $100K. Tom has the right to buy at the agreed price of $100K but remember he has already paid an upfront fee to Jerry to get into this contract so Tom is actually making a loss in this case. Let’s understand the calculations.

Case3

And the final scenario is if the company backs up from the plan and there is some news in the market that this area has some kind of water issues as well. Because of this, the prices of these condominiums plummet to $50,000. This would be clearly a loss for Tom but how much would he actually lose? Remember he has the right to buy but not an obligation to buy it. However, he has already paid the upfront nonrefundable fee to get into this agreement so let’s see how much he will lose in this case.

This story is the crux of how options work in the stock market so let’s put some options lingo into this example and try to put an analogy.

Options Agreement

The agreement between Tom and Jerry is called an Options Agreement.

- The condo is called the Underlying as the whole contract is about that.

- In our story, Tom can be called the buyer of an option and Jerry would be called the Writer/Seller of the option.

- The nonrefundable fee that Tom paid is called a Premium

- The end of the month when this contract is ending is called as Expiration Date

Actual Stock Example

Now we can switch gears and take this analogy to the actual stock options and understand it with a concrete Stock example.

Please note that I will not go very deep into the stock example and will intentionally keep it simple for now. Once we get a good handle on this example ( Which is by the way called buying a call option) we can build upon that to get into more of the other options strategies including selling calls and puts which are my two favorite strategies for passive income. But before that let’s dive into this example.

Also Read

Let’s assume that a stock is trading at $100 ( a.k.a. Spot Price) in the current market and you are given the right to buy this stock one month out from now at a price of $105 ( a.k.a Strike Price). The price of this stock goes up to $110 at the end of 1 month. Would you be buying this at $105?

Of course, you will as the current market price is at $110 but you get to buy the same stock for $105 only so you are clearly making a profit of $5 (a.k.a Premium) per share on this deal.

However, you are required to pay a premium of $2/share to get into this deal would you still sign this option contract?

Of course, you will as you are still making a $3 profit per share ( $5 – $2) after deducting the premium that you paid to get into this contract. This is what is called buying a call option.

But what if the price of that stock goes down to $95 at the end of the month? What happens then? so similar to our Tom and Jerry story there are only 3 possibilities here that can happen either the price of the stock will go up or stay the same or it will go down.

Let us compare all these three scenarios side by side to give you a clear picture of how the profit/loss would look for you in buying a call strategy.

One more key point that you need to understand with respect to the US stock market is that 1 option contract in the US market is always considered 100 shares. So any profit/loss scenarios that are presented here will have a multiplier of $100 for the total profit and loss calculation.

Call Option – Profit/Loss

As you would clearly see from the examples it ONLY makes sense to buy a call option if you expect the stock price to go up in the near future. This is essentially the core principle of how buying a call option works.

Price Goes Up

Current Market Price (Spot Price): $100

Contract Price (Strike Price): $105

Expiration of Contract: 1 Month

Price At the End of the Month: $110

Front Cost ( Premium): $2

Profit/Loss: $110-$105 = $5

Total Invested: $2x$100 = $200 Total Returned = $5x$100 = $500

Profit: $300

Price Goes Down

Current Market Price (Spot Price): $100

Contract Price (Strike Price): $105

Expiration of Contract: 1 Month

Price At the End of the Month: $95

Front Cost ( Premium): $2

Profit/Loss: $95-$105 = -$10

Total Invested: $2x$100 = $200 Total Return = -$10x$100 = -$1000

Loss: $200

Price Stays Flat

Current Market Price (Spot Price): $100

Contract Price (Strike Price): $105

Expiration of Contract: 1 Month

Price At the End of the Month: $100

Front Cost (Premium): $2

Profit/Loss: $100-$100 = $0

Total Invested: $2x$100 = $200

Total Return = $0x$100 = $0

Loss: $200

Key Takeaways

- The buyer of a call option has the right but not the obligation to buy the stock

- A seller always has the obligation to deliver the stocks

- At the time of option, purchase buyer is required to pay a premium that goes straight to the seller no matter the outcome.

- The option contract is set at the predetermined price called the strike price at a predetermined time called the expiration date

- In the US market, 1 option contract is always equal to 100 shares of stock

- If the stock price stays the same or goes down buyer makes a loss and that’s why it always makes sense for a buyer to buy a call only if the stock price is expected to go up.

- The seller of the option has higher odds of winning from the stock movement

Option Lingo

There were many options jargons that we came across in the last section, let us review them here with their official and proper definition.

This is the future price of the stock at which the contract is agreed upon. It could be more or less than the stock price depending on the options strategy.

This is the end date of the options contract. This could be weekly or monthly or yearly or days as well. Most of the stocks allow weekly options however some derivatives like SPY allow less than a week as well.

This is the price paid by the buyer of the contract to enter the contract. Or vice versa the amount received by the seller of the contract to fulfil the obligation.

This is nothing but the current market price of the underlying stock.

This is just a quick overview of the terminology used in options however they each require a more in-depth explanation and also there are some more options jargon that you should be familiar with to get a good grasp on the options.

You should refer to the article options trading terminology to get a complete in-depth knowledge of different terminology related to options trading.

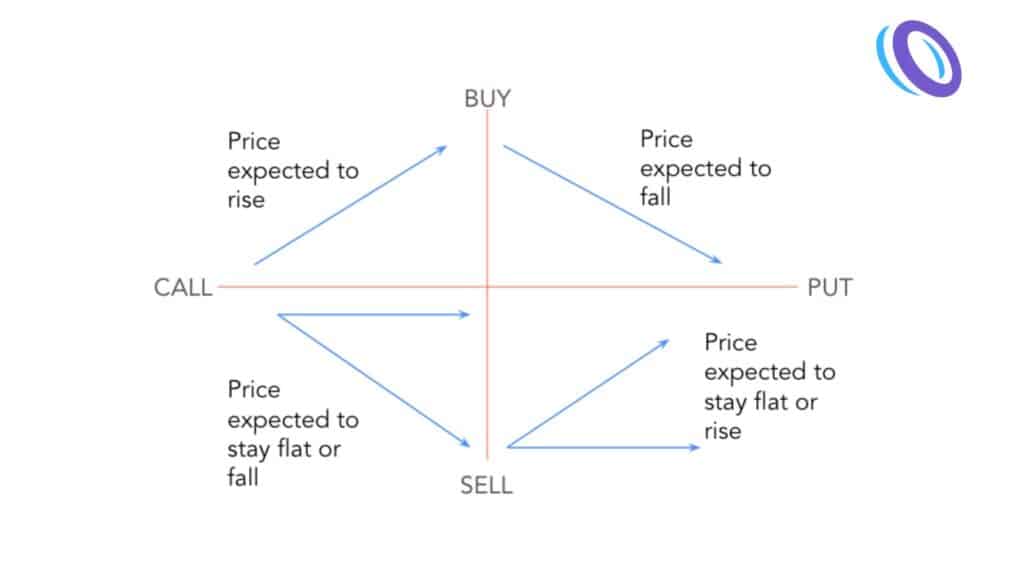

Dimensions of Options

Ok, so far we have only looked at 2 dimensions of the option which are Buy and Call. There are two more dimensions to the options which makes the options really interesting and provides it with full flexibility.

They really open up the options to make money in any kind of market environment and any type of stock movement. You can make money with options whether the market is going up or going down or moving sideways. There are different strategies to suit all kinds of possibilities that can happen in the market.

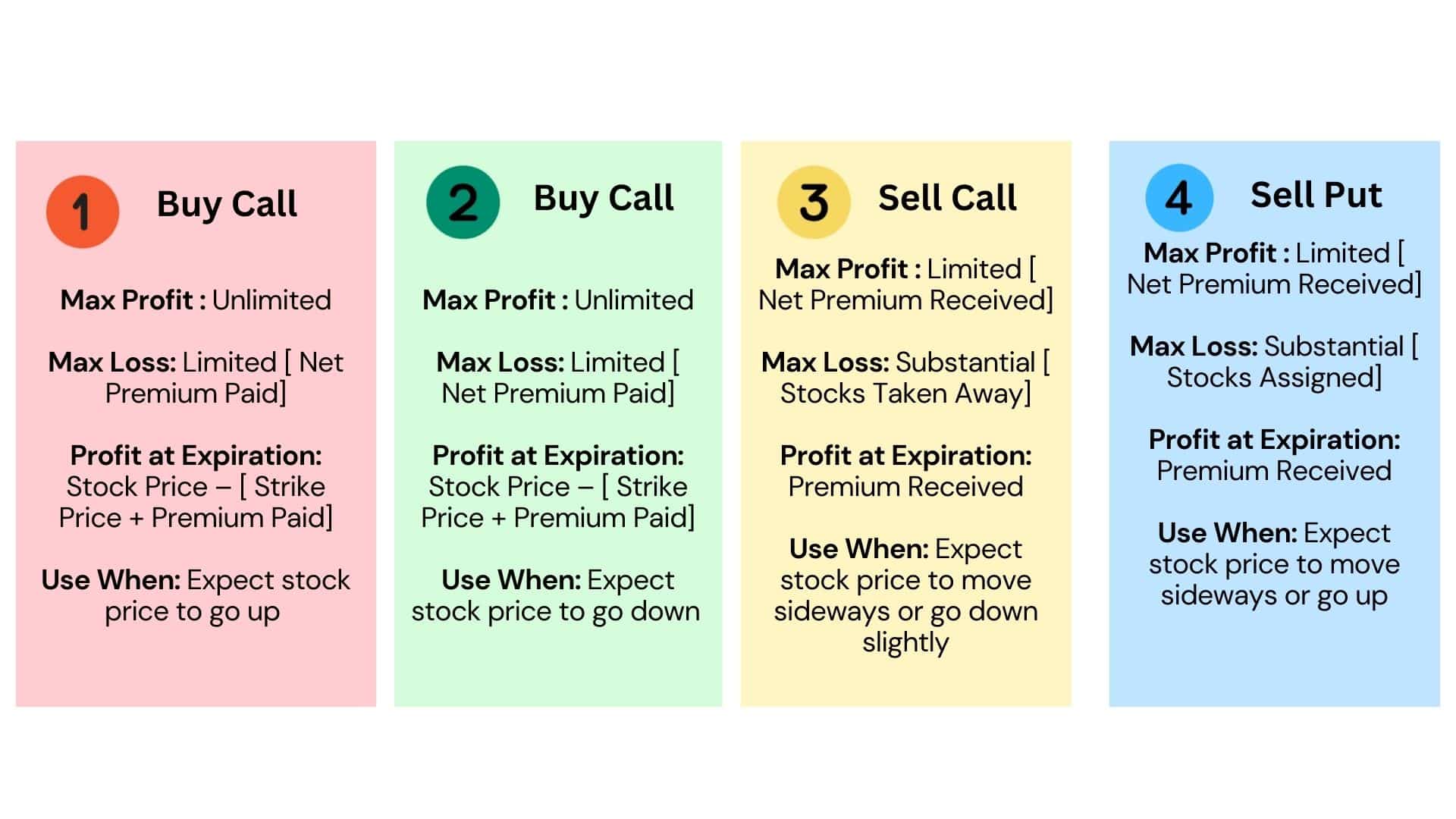

The other two dimensions are Sell and Put. Here is a quick chart to give you an overview of all four dimensions together and which one is suited for which movement. We will go into each of them in more detail in different articles but this is just to show you the power of options when it comes to generating money from the stock market.

There is one key point that you should remember when trading options is to look out for liquid stocks. If the underlying is not liquid it becomes difficult to get the contract filled. You may use this resource to find the most active stocks/ETFs. They should all have a good amount of liquidity on any given day.

We will keep referring back to this diagram as this really includes a lot of core logic and strategies of how options trading works. But first, let’s understand briefly the Sell and Put options.

What Is A Put Option?

If you have understood the concept of the call option then it would be pretty easy to understand the put option. Think of the put option as exactly opposite to the call option.

Remember that a buyer of a call option has a bullish view of the market meaning a call buyer expects the market to go up and a put buyer expects the exact opposite that put buyer will always have a bearish view of the market meaning the put buyer expects the market to go down to make money.

Very similar to the contract of call option which we discussed earlier, the put option is also a contract between a put buyer and a put seller. You just need to completely reverse the context.

If you remember from an earlier discussion, a call buyer makes money when the market goes up, and a call seller makes money if the market goes down or stays flat. In the case of puts, a put buyer would make money if the market goes down and a put seller would make money if the market goes up or stays flat.

So essentially think of Call and Puts as two sides of the coin. Everything that you know about calls is exactly the opposite of how to put works.

Put options contract also follows very similar steps as the call options contract:

- The put buyer pays a premium to get the right to sell the stocks to the put seller

- Put seller in turn receives the premium and agrees to the obligation of buying the stocks

- If the put buyer decides to exercise his right at the contract expiry ( expiration date) then he gets to sell the stock at the agreed contract price (strike price) and the put seller will be obligated to buy this stock from the contract buyer

- And just opposite to the call buyer contract in this case a put buyer will only be interested to exercise the right to sell the stock if the market goes down.

This is just a brief overview of what the put option is and how the contract works for put. However, this is just scratching the surface of it. There is more to this which we will go into more detail when discussing the options strategies of Buying a put and Selling a put.

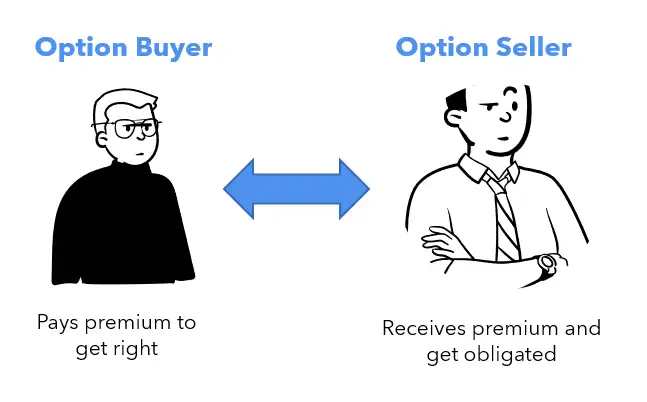

Buying V/S Selling Option

We have been mostly focused so far on the buying side of options. However, the options market is a zero-sum game, for every option that’s bought there has to be a seller for that option. If one makes money the other party is bound to lose.

Let’s look at the options from a seller’s point of view. I personally like the selling part of the options more compared to the buying part. One of the primary reasons for this is the odds of winning. If you remember from the Tom and Jerry use cases that we had outlined before. A seller of the option always has a higher chance of winning the contract.

In the case of a selling call option, the call contract seller wins if the market goes down or it stays flat. The seller always collects the premium paid by the buyer of the contract.

Similarly, in the case of the selling put option, the put contract seller wins if the market goes up or it stays flat. In both cases put seller will collect the premium.

Selling options is one of the best market strategies that I can recommend to anyone looking to reduce the risk in the market and generate a consistent weekly or monthly income from the premiums paid by the buyers. We will explore the strategies around selling options in greater detail in different articles.

Simple Option Strategies

Based on the graph that we saw earlier on the option dimensions, there are primary four simple option strategies also known as single leg option strategy as it involves only a single leg of execution.

You can leverage these strategies to make money in all types of market conditions. I will provide a very brief overview of these strategies here as each of these strategies requires dedicated articles of its own. So we will discuss the complete strategy with step by step process on how to execute each of them in separate articles.

Buying A Call

The real-world example that we had discussed earlier Tom and Jerry is exactly how buying a call strategy works. You pay a premium to buy an options contract which gives you the right not obligation to buy the stock at a predetermined price ( strike price) on or before the predetermined date ( expiration date).

You would be using this strategy if you expect the market to move up as this gives you a chance to make an unlimited profit as there is no upper limit on how high the stock will go up. Also, your risk is capped at the premium that you paid while getting into the option contract.

Buying A Put

Buying a put strategy is exactly the opposite of buying a call strategy. In this, you are betting on the market to go down. You pay a premium to buy an options contract which gives you the right not obligation to sell the stock at a predetermined price ( strike price) on or before the predetermined date ( expiration date).

You should make use of this strategy if expecting the stock to go down in price. The more a stock goes down the more you make the profit. And there is no upper limit on how much profit you can make. Also, your risk is capped at the premium that you paid when getting into the option contract.

Selling A Call

Selling a call is the other side of the equation from buying a call. In this strategy, you are the seller of the option contract. Remember in buying a call strategy option buyer needs to pay a premium to get into the contract. That premium is received by the seller. As a seller of the contract, you get to keep the premium and are also obligated to sell your stock should the option buyer choose to exercise their right to buy.

This is one of the less risky strategies and one that is used by many large investors as well to hedge their portfolios and generate a consistent profit. You should be using this strategy if you expect the market to move sideways or go down.

Selling A Put

Selling a put is the other side of the equation from buying a put. In this strategy, you are the seller of the option contract. Remember in buying a put strategy option buyer needs to pay a premium to get into the contract. That premium is received by the seller. As a seller of the contract, you get to keep the premium and are also obligated to buy the stock should the option buyer choose to exercise their right to sell.

This is again one of the less risky strategies and one that is used by many large investors to start a position on a particular stock at their desired entry point. You should be using this strategy if you expect the market to move sideways or go up. The best strategy is to buy your favorite stock at the price that you want. More on that later in the detailed article.

Option Strategy Comparision

Here is a quick comparison between all the basic option strategies.

Advanced Options Strategies

Apart from these simple strategies, there are various advanced options strategies also called multi-legged or spread strategies as they are a combination of multiple simple option strategies.

These advanced strategies you can leverage to make the most out of options. However, it takes a little bit of lurving curve to get a good grasp of the advanced options strategies. And I would strongly recommend that you first get very comfortable working with simple options strategies that are outlined in the previous section.

For instance, many individuals view the running a wheel strategy on SPY (the S&P 500 ETF) as akin to receiving rental income, as it is considered an exceptionally safe approach for this particular strategy.

This list is not exhaustive and in no particular order of preference. They all are meant to be used in different market circumstances.

- Call Credit Spread

- Put Credit Spread

- Call Debit Spread

- Put Debit Spread

- Long Straddle

- Short Straddle

- Wheel Strategy

- Leap Calls

- Iron Condor

- Poor Man’s Covered Call

All of them does require a detailed guide to get the concept completely clear therefore we will be discussing each of them separately in its own article.

FAQ

Options trading requires good knowledge and experience of how options work however that doesn’t apply to all the option strategies there are some simple options strategies that are both easy to execute, profitable, and safe and that would be a good starting point for beginners.

Yes! It is indeed possible to trade options with as little as $100. Within this budget, you have several options and strategies at your disposal. Among these strategies, there are riskier ones, such as buying a call option. While they carry higher risk, they can also be highly profitable, potentially yielding returns of over 100%.

On the other hand, there are less risky strategies like spreads which require very minimal investment. Although they may not offer as high returns, they increase your chances of winning and tilt the odds in your favor.

Absolutely not! Options trading is far from being a gamble; in fact, it is a highly versatile trading strategy that allows you to capitalize on various market conditions. While there are strategies that carry higher risk but offer potentially higher rewards, there are also strategies that may not yield as much profit but boast nearly 100% winning odds, such as the wheel strategy.

The wheel strategy is an excellent option for those seeking consistent returns. If you want to learn more about the wheel strategy, you can check out this informative article: wheel strategy.

Yes, you can very well learn the options trading ins and outs with self-learning. There are various strategies in options and you can start with simple ones like buying a call or put and selling a call or put and then move on to advanced strategies as you gain experience.

Here is a good pointer to start learning option basics today.

There are various strategies when it comes to options trading for every type of market condition. Some are higher risks than others however if you understand how options work and apply the right option strategy according to market conditions then option trading can be highly profitable.

There are strategies like the wheel strategy or selling a call or selling a put that can generate consistent monthly and weekly income.

It is quite common for beginner traders to experience losses when trading options. Options provide the opportunity to leverage positions by multiples, which can be enticing but also risky. For instance, buying a call option very close to its expiry in hopes of a significant swing in stock movement can result in a complete loss of your investment.

That’s why I suggest considering selling options instead. While selling options may not offer substantial returns, it provides a more consistent profit over time, which can be a safer approach for beginners.

Hope you have got value out of this article. If you have any questions feel free to comment down below or send in your questions through contact us page.