Cash secured puts are a great strategy that even Warren Buffett uses to own stock at the desired price. It is one of the wonderful strategies in the options trading world that anyone can use to own the stock at their desired price or just to generate consistent income.

In this article, we are going to see how to sell Cash Secured Puts on the Robinhood platform. I will walk you through step-by-step how you can execute this strategy in a very simple manner on the Robinhood platform. So without any further ado, let’s get started.

If you are a complete beginner in options trading, then I would recommend that you check out the Options 101 article first. That will give you a good, comprehensive idea about the nitty-gritty of options trading. Then you can jump back into this article, which will give you a better understanding.

What is Cash Secured Put? | The Basics

Cash secured puts are an options strategy which by definition is a contract in which you are obligated to buy 100 shares of a particular underlying stock at a strike price on or before a given expiration date. For this, you collect a premium.

In this strategy, you sell a put below the current market price of the stock. If by the expiration date, the stock has not reached the strike price, then you get to collect the premium and you do not have to buy the stock.

However, if the stock ends up below your strike price by the expiration date, then you are forced to buy 100 shares of the stock at the strike price, even if the current market price is lower than the strike price.

This is cash secured put in a nutshell. As we go into more detail, we will also look at some of the tips, considerations, and risks involved while executing the cash-secured put strategy at the end of this article. Now let’s look at how you can execute the steps for cash secured put in Robinhood.

How to Sell Cash Secured Puts on Robinhood | Step By Step

Step 1

The first step in executing a cash secured put in Robinhood is to go to the underlying stock that you want to execute the put on. For this example, I am choosing AMD stock. So you navigate to search for AMD and then go to the AMD stock page.

Once you are on this screen, you have to click ‘Trade’.

Step 2

Once you click on the trade you will be presented with 3 options. “Trade Options”, “Sell” and “Buy”.

Click on “Trade Options” here.

Step3

Once you are on the AMD options page, at the very top you will see different dates – these are the expiration dates. Since AMD has weekly expirations, you would see weekly dates here. Below that, you will see 4 different options to choose from: Buy/Sell and Call/Put. These are the options you can select.

To execute a cash secured put, you need to select “Sell” and “Put” as shown in the screenshot.

The typical expiration date you should go for is between 30 to 45 days out. In this example, I have selected September 22, which is about 1 month out from today.

Step 4

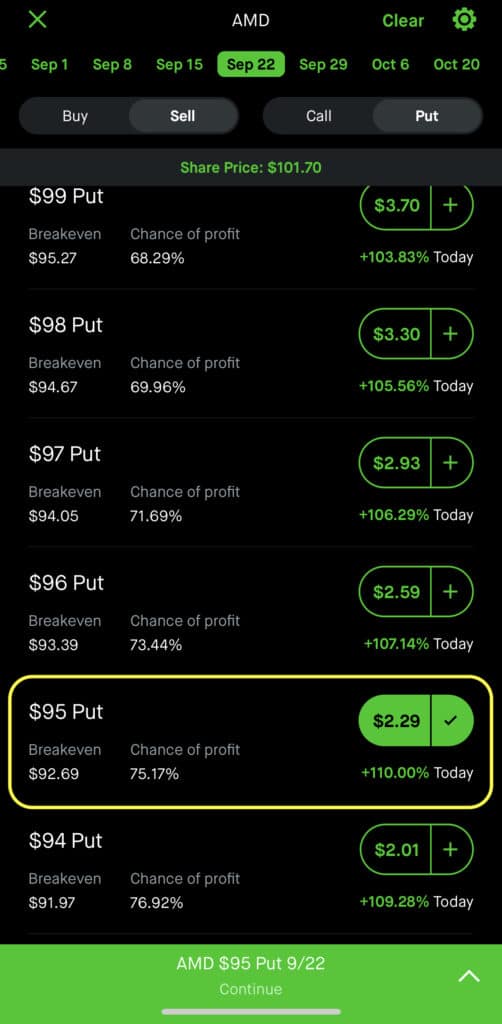

Once you click on the expiration date and select sell/put, you will be presented with the options chain for AMD. This will be listed according to strike prices on the left-hand side. You will see different strike prices, and on the right-hand side, you will see the premiums listed. So for a particular strike price, you can see how much premium you are getting.

Now you need to select a strike price.

When choosing strike price if your goal primarily is only generating income and not owning the stock then you should go with delta which is less than .3 so you have a good chance that the option contract will expire worthless.

However, if your primary goal is to own the stock then you can be a little more aggressive and sell ATM calls which are very close to the money.

For this example, I do not want to own AMD stock so I have chosen a strike price of $95 which is less than 0.3 delta.

And to open this contract I would receive a premium of $229 as highlighted in the screenshot.

Remember 1 option contract is equal to 100 shares of stock so $2.29 is $229 in dollar terms. ( $2.29 x 100).

Now click continue.

Step 5

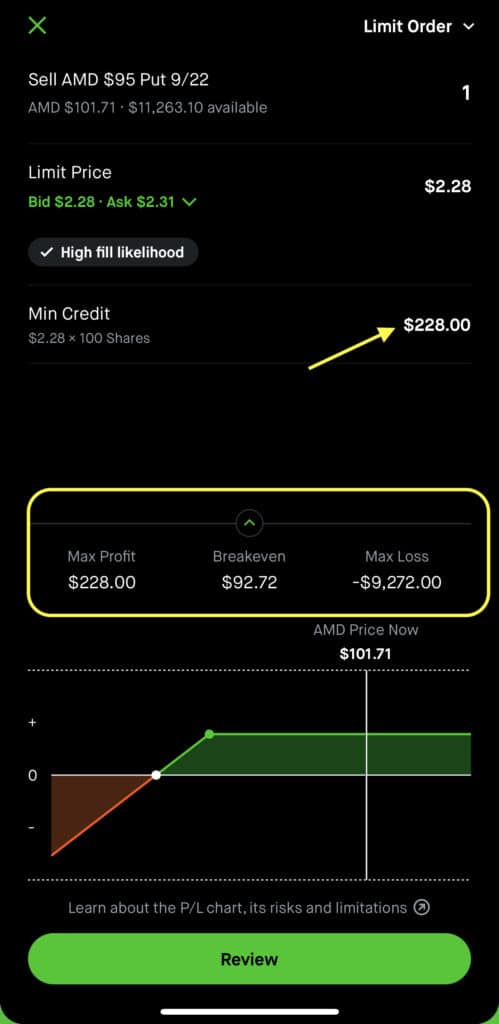

Once you select the strike price, the next step is to enter a limit price. You can either select a high price, the ask price, or something in between.

Usually, if you want to get your order filled immediately, you should go with the ask price. You can choose something in between, but note that it may take some time to fill your order. So it is best to just select the ask price to get your order filled immediately.

In this example, I have selected the Bid price as $2.28 which means I would receive $228 as a premium once the order is filled.

It also shows the max loss and max profit numbers for this trade down below as you can see in the screenshot. I will discuss the max profit and max loss graph of a cash secured put in full detail below.

For the purpose of this example our max profit is the premium received $228 and max loss is the cost of owning 100 shares of AMD stock at the strike price minus the premium received which is $9,272.

Do remember though that it is not technically a realized loss unless you sell the AMD stock that you were forced to buy at the strike price. You can always wait for the stock to move up and then sell it for a profit.

You can then click review.

Step 6

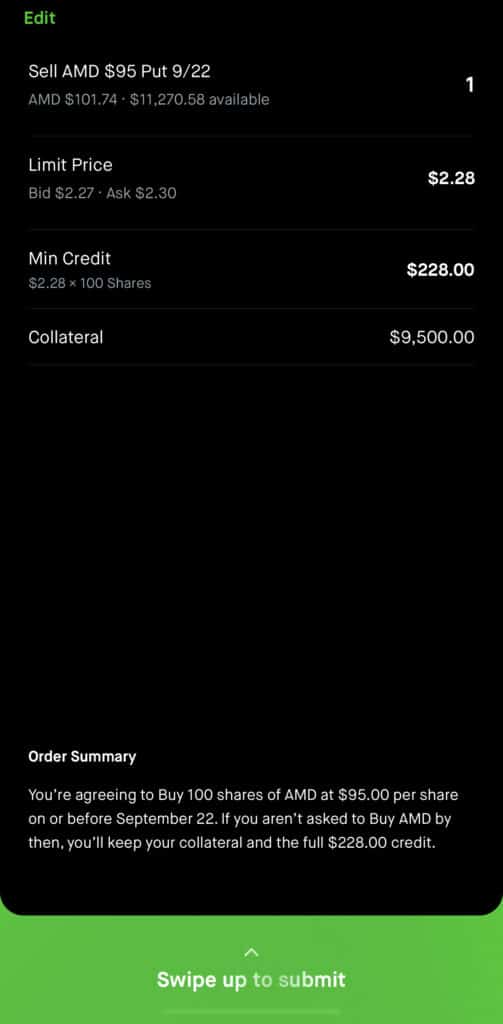

The final step is to review all the details like the limit price, minimum credit, and collateral.

Collateral in this case would be equal to the cost of owning 100 shares of AMD stock at the strike price which is $9500 ( $95×100).

Once reviewed, you may swipe up to submit the order.

Profit And Loss Explanation

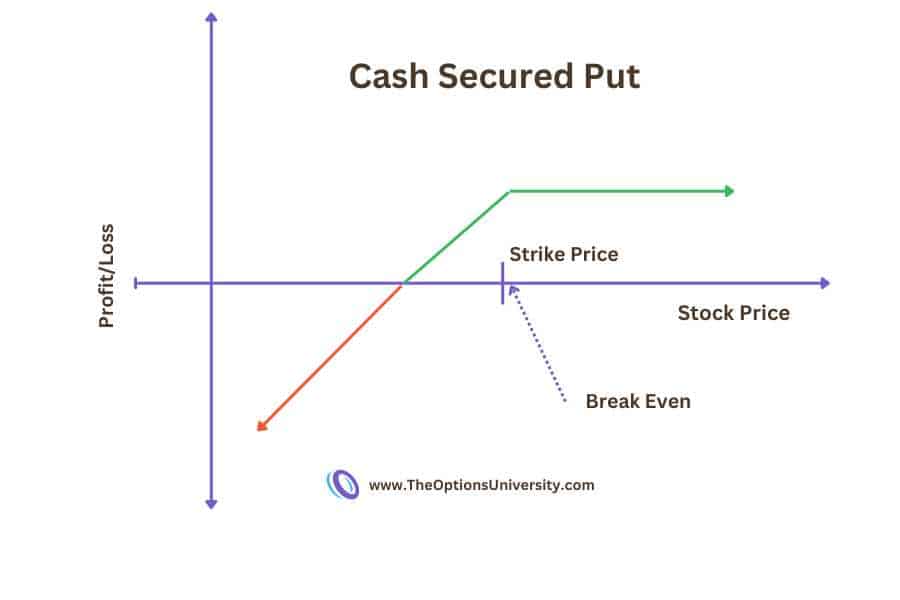

The graph of profit and loss for a cash secured put would be below. As you can see clearly the max profit is always capped in this strategy which is equal to the premium received.

Also Read

The max loss is shown as unlimited however that is just the cost of owning 100 shares of the stock at the strike price. It is not considered a realized loss until you sell the stocks.

Tips, Considerations, And Risks

Cash secured puts are fairly safe options strategy however there are some tips and risks that you should be aware of when executing this strategy for maximum success.

The first and very important step is to ensure that you only execute the cash secured put strategy on stocks with very strong fundamentals. In case you are assigned the shares, you do not mind owning the stocks – whether you are doing it to generate consistent income or you actually want to own the stock. There is always a possibility that you will have to own the stock if it drops below your strike price. So always choose a stock that has good fundamentals and a good chance of recovering in the future if assigned.

Strike price selection is also very important when doing a cash secured put because you have to choose a strike price depending on what your end goal is. If your end goal is to ultimately own the stock, then you can be more aggressive and sell the puts at-the-money, which is very close to the stock price.

Or if your goal is to simply generate consistent income, then you should choose a strike price that is at least 0.3 delta or below so that you have a very good chance that the stock would not be put to you.

Choosing the expiration date (Date to Expiry) in cash secured strategies is also very important. You should typically choose an expiration date which is at least 30 to 45 days to expiry.

This allows the overall theta decay to play its complete role because as you would probably know, theta decay increases as you get closer to expiry.

Based on several backtesting done around this strategy, this is the best timeframe for theta decay to actually come into play.

One very important tip that you should always remember is to never sell naked puts. Robinhood does not allow doing this, as you will have to put up collateral equivalent to 100 shares of the stock.

But some platforms may allow naked puts – never do that because it puts you at risk of a margin call. If you do not have money to buy the stock, you will get a margin call and they will try to recover it by selling other stocks in your portfolio.

Always keep some cash in reserve when you execute this strategy. This is so that if the stock is assigned to you and keeps going down, you will have some money to average it down.

If required, you can then sell covered calls on it to recover some of your losses. It is always best to keep some cash set aside to manage your position and dollar cost average into the stock.

Final Thoughts

I hope now after reading this article you are clear on how to sell cash secured puts on Robinhood platform.

To conclude, I would just say that as long as you keep in mind the tips, considerations, and risks that we discussed, you will be able to successfully execute this wonderful options strategy. Whether your goal is to generate income or to own the stock, you should be able to execute it successfully.

If you have any questions regarding this or anything else that you think we may not have covered here, you can always reach out to us using the contact form or email us at [email protected].