If you are new to options then you might have heard a lot of options trading terminology that goes along with it.

You may also call them options jargon if you wish however It is really important to get the basics of these terms right as this would undoubtedly give you a solid foundation that will help you make the most out of options trading.

If you are completely new to options trading then you can first check out the article on options trading 101. That should get you started in the world of options.

In this article, we will discuss each of them in detail with some possible examples. Here is a quick list of the options and terminology that we are going to discuss:

Strike Price | Option Strike Price

In very simple terms strike price is the price on which both parties buyer and seller agreed to enter into the option contract.

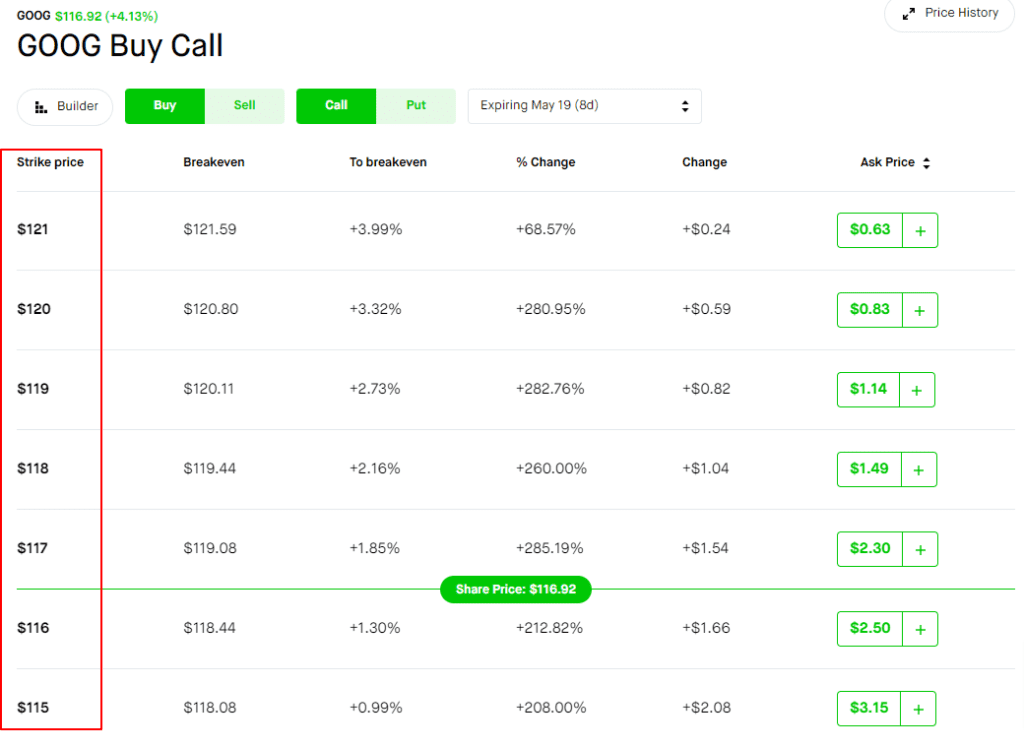

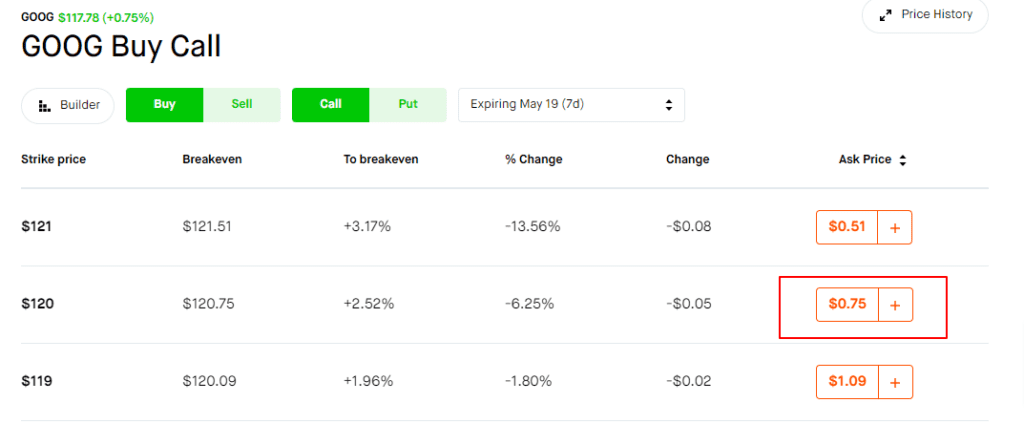

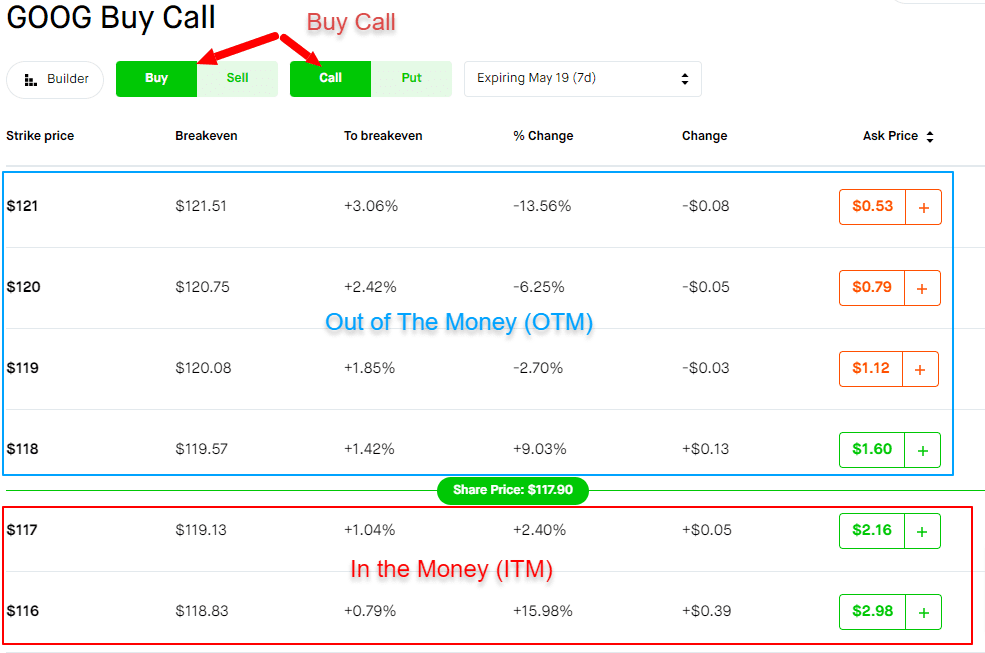

Let’s take an example of the Google stock options chain. Below is a screenshot of what the option chain looks like in the Robinhood app for Google stock. You can ignore all the other values here for now and just focus on the highlighted one. As you can see the very first column here represents the strike price. So each row here represents the numbers according to the strike price.

The first thing that you need to choose and decide when executing an option is the strike price. This price would determine what are your chances to win the trade or how much risk you are willing to take entering into the contract.

Every other parameter that you see in the below option chain depends on what strike price you choose.

Spot Price | Option Spot Price

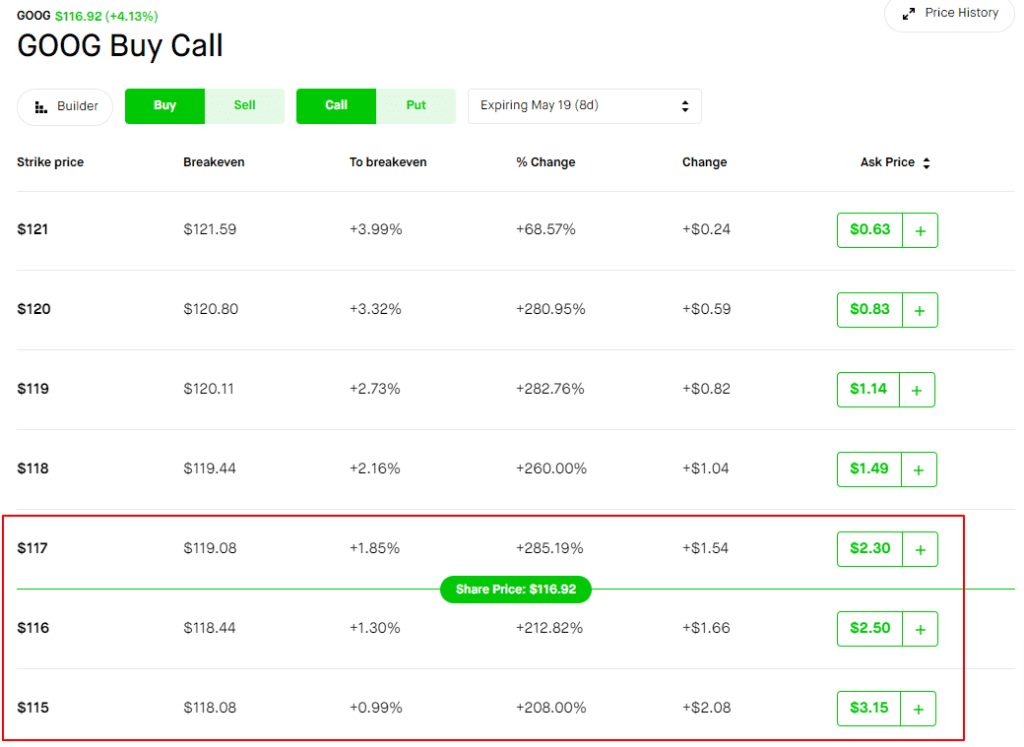

The spot price or it is also called the underlying price is the current market price for the stock. Like in the above example the spot price of Google stock is $116.92.

The prices for contract premium which we are going to discuss next changes based on what strike price you choose and what is the current spot price for the stock. The closer you are to the spot price the premiums will be higher and the far you go from the spot price the premium tends to go down so your chances of winning.

Also, remember spot price is a changing parameter which means if tomorrow the stock rises to $118 then that would be the new spot price. So simply put whatever is the current market price of the underlying is the spot price.

Option Premium

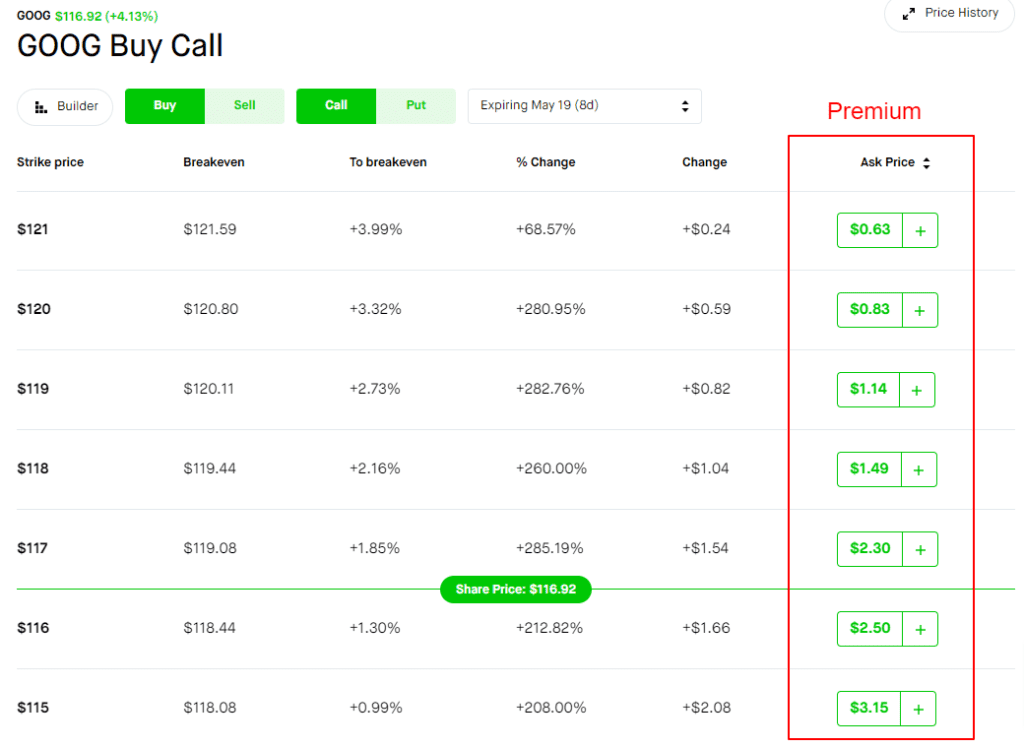

Premium is the price you pay upfront as the buyer of an option and it is the amount that a seller receives to enter into the contract.

In the below example, the last column represents the premium that you have to pay to buy a call contract. So if you want to buy a Google call at the strike price of $120 you will have to pay a premium of $83 ( $.83×100). Remember in the US market every contract lot needs to be of 100 stock therefore it is $83.

Buying this contract gives you the right to buy Google stock on or before the expiration date ( i.e. May 19th) for $120 irrespective of whatever happens to the price after you buy the contract.

Option Expiration Date

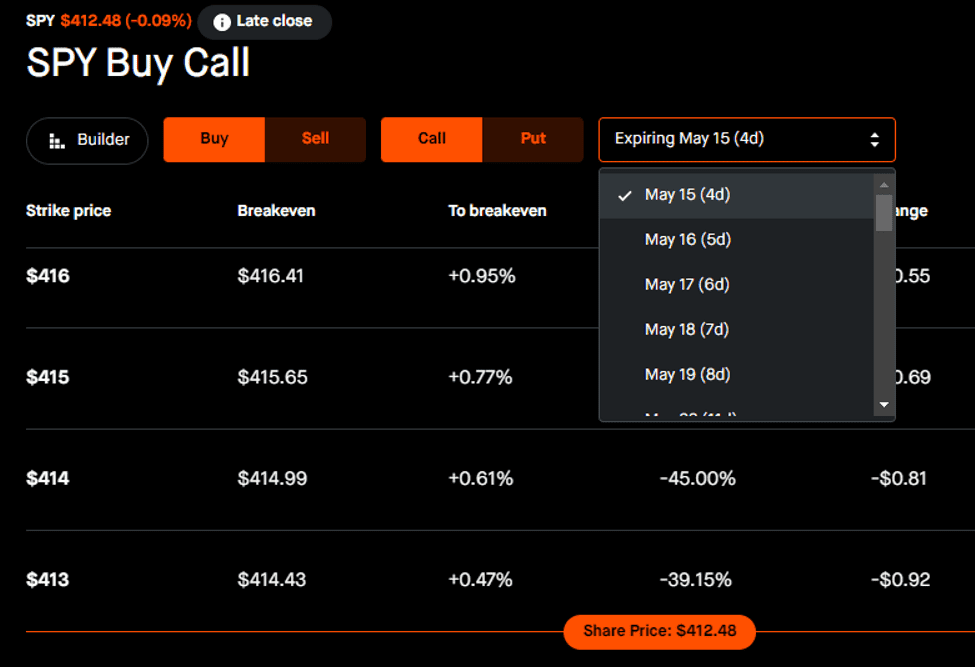

The expiration date is the pre-determined date on which the contract will be set to expire. Most of the options expire on Friday every week unless it falls on a US public holiday in that case it would expire on Thursday.

However, there are some derivatives that have expiry dates multiple times a week. A very popular one among them is the SPY. SPY is an ETF that tracks the movement of the S&P 500 and this has multiple expiries a week.

As you can see SPY has multiple expiry dates almost every other day. It is a highly popular and probably the most liquid options chain in the US stock market.

Similar to this QQQ which tracks the NASDAQ 100 also has multiple option expiry within a single week.

Intrinsic Value

The intrinsic value of an option is how much the stock price is above the strike price. So for example, if the current market price of Google stock is $120 and you bought a call option at the strike price of $118 then the intrinsic value of the option would be $200 ( $2*100).

The difference between the Spot price and strike price. The multiplier of 100 is added as 1 option contract is always equal to 100 stock.

Intrinsic Value = Spot Price – Strike Price

Let’s take another scenario

- The current market price of a stock is $100

- You buy a call option for the strike price of $120 with an option expiry of 7 days.

- The price of the stock goes up the next day to $150.

- How much is the intrinsic value you have on this stock?

The right answer is $3000 and how did we arrive at this number? Well, we take the difference between the current spot price ( $150 ) and the strike price ( $120) which is $30, and then multiply it by 100 which gives us $3000.

Extrinsic Value

Extrinsic value is basically the difference between the premium and the intrinsic value of the option. If this may sound a bit confusing do not worry we will explain with the help of an example.

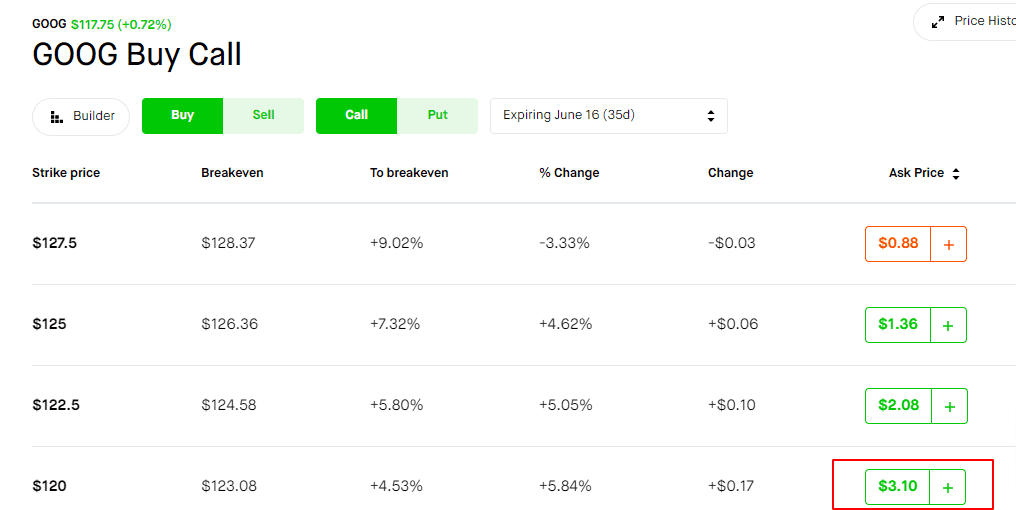

Let’s take the example of the Google option chain again. In this, if you observe the premium for the same strike price is different for two different expiration dates. Why do you think it’s different?

If you guessed it’s because of the time, then then you are right. You would have heard that Time is Money, the extrinsic value is a prime example of that.

Also Read: Options Trading for Beginners

The far you go down in option expiry date the premium increases. So as an option buyer, a weekly option will cost you less than an option that expires in a month.

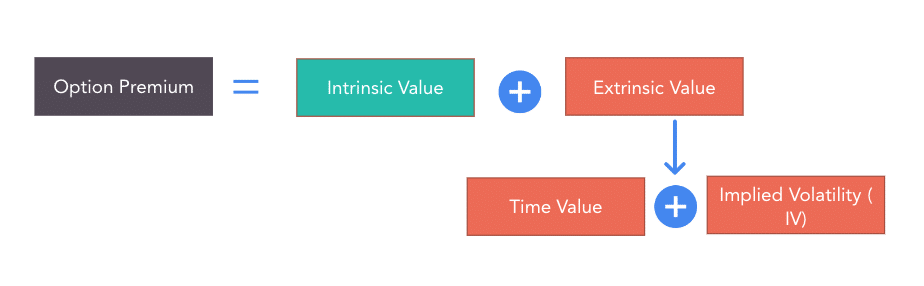

This “Time Value” is what constitutes the extrinsic value of an option. There is one more factor Implied Volatility ( IV) which we will be discussing shortly. Essentially combining these two factors is what determines the extrinsic value of the option.

Here is a visual representation of how all of these factors are tied together.

Here is a real example from the Google option chain.

This is the option chain for May 19th. If you were to buy a call option with a strike price of $120 you would be paying a premium of $75.

And this is the option chain for June 16th which is about a month out from the previous one. If you were to buy the same $120 strike call option you would be paying a premium of $310.

So the difference that you see which is about $235 ( $310 – $75) for the same strike price is because of the time value or extrinsic value of an option.

At the Money Option | ATM Option

At-the-money call or put options are basically options whose strike price is very close to the current market price ( spot price) of the underlying.

Usually, the premiums you would as pretty high for the at-the-money options. Going back to our Google example as the current market price is hovering around $116+. The option with a strike price of $117 and $115 would be considered the at-the-money options.

You can see that premiums for them are $230 and $250 respectively. However, as you move your strike price away from the spot price the premiums start to go down.

In the Money Option | ITM Option

An option is called In the Money option ( ITM ) if the strike price is less than the current market price for a call option or if the strike price is more than the current market price for the Put option. The definition of ITM option changes based on if the option is a call vs put.

Let’s understand from the same Google example again.

This is a buy call option chain for Google, whatever strike price that you see below the current market price of Google ( i.e. $117.90) is called ITM ( In the Money) option. And whatever strike price is higher than the current market price is called the OTM ( Out of the Money) option.

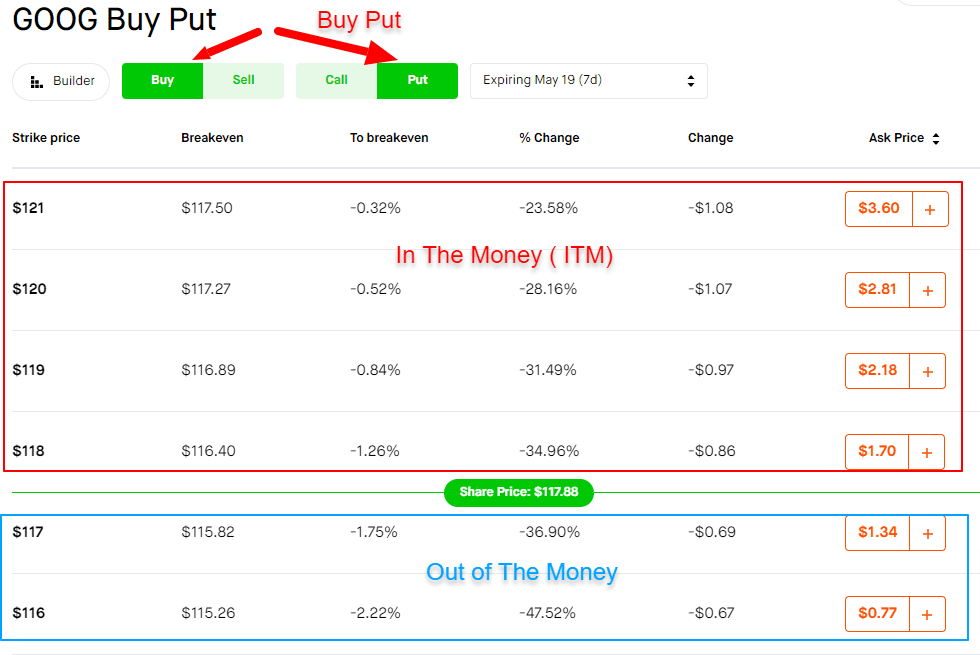

As mentioned the context and definition of ITM and OTM option changes for the put. Remember buying a put option means that you essentially expect the market to go down.

It is exactly the opposite of the put option. Below is an example of Buying a put option, whatever strike prices are below the current market price are called OTM ( Out of the Money), and whatever strike prices are more than the current market price are called ITM ( In the Money) options.

Out of The Money Option | OTM Option

If you understand the In money concept then this is fairly straightforward.

An option is called the Out of Money option ( OTM ) if the strike price is more than the current market price for a call option or if the strike price is less than the current market price for the Put option. Same to the ITM option the definition of the OTM option changes based on if the option is a call vs put.

The same examples which we detailed for the ITM option apply here. The strike prices which are surrounded in blue are the strike prices that fall under the OTM option.

Implied Volatility | Implied Volatility Options | IV Options

Implied Volatility is a measure of expected volatility in the underlying stock price. Or in other words, it signifies the rate at which stock is expected to move up or down in percentage terms.

Let’s understand volatility with a real-world example. Suppose there is some kind of rumor that starts to go around about the next pandemic you would immediately see some of sudden price action on a few commodity prices. However, as the rumor burst the prices will come crashing down. This is called volatility.

It is essentially the amount and frequency of any change and how swiftly that occurs.

The same applies to the stock market, you might find some bio company-related stocks that shoot up 500-1000% in a few days due to some successful vaccine trial. Or vice versa they may go down 1000% due to some news about people getting sick because of their medicine. These stocks would be called as highly volatile in nature.

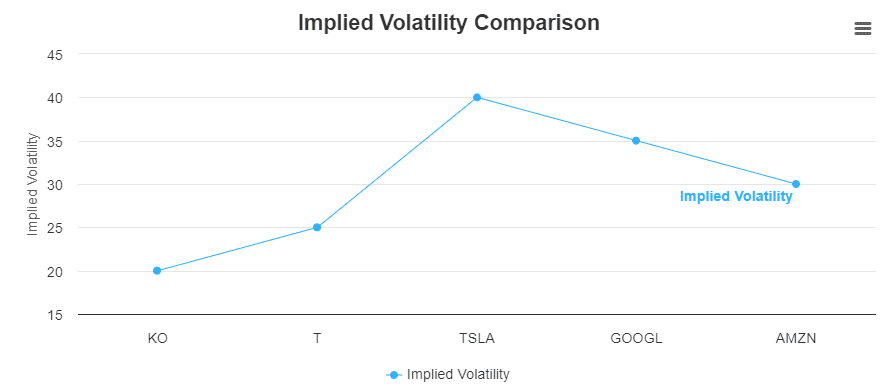

When it comes to options this a one of the very critical factors that determines the premium for the option. It determines the extrinsic value of the option. The higher the Implied volatility ( IV) the higher the premiums.

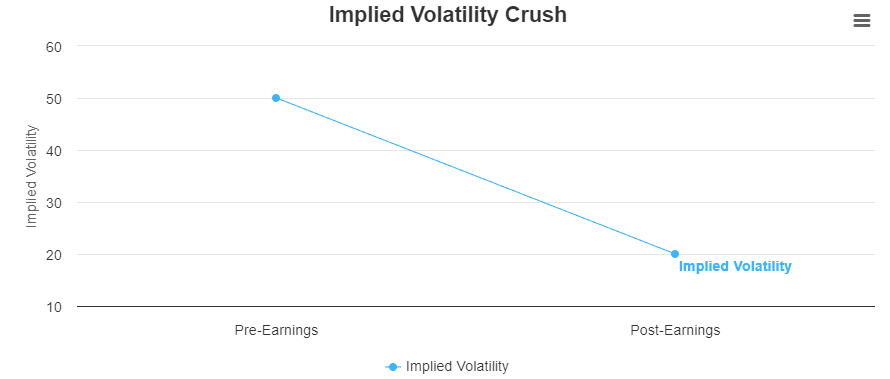

A classic example of IV swing is the earnings seasons. If there are earnings coming up for any stock you would find the IV shooting up a week before for that stock and so the premium. And as soon as the earnings are over the IV goes down and so does the premium. This is knowns as IV crush and there are a few options strategy specifically to take advantage of this situation as well.

Below is an IV chart of a few stocks, as you can clearly see that Coke and AT&T have way less IV compared to Tesla or Google. This is because the price action of AT&T and Coke is much more stable than for example Tesla.

Final Take

Hope you get some value out of this article on options trading terminology. Please note that each of these factors ultimately decides how options prices will move. If you get a good handle of these different factors you can become a very successful options trader.