Covered calls are one of the best options strategies you can find in the options trading world. If you have at least 100 shares of a stock and you are not selling covered calls, then you are missing out on extra income-generating opportunities.

In this article, we are going to discuss and walk you through step-by-step how to sell covered calls on Robinhood. Along with this, we are also going to look at how the profit and loss chart looks for covered calls.

Then, at last, we will see some tips and considerations you should keep in mind to protect your capital and avoid losses with the covered call strategy. Without further ado, let’s get started.

If you are a beginner in options trading then you should check out the Options 101 article which provides complete detail on how you can start options trading.

The Basics

A covered call is a strategy where you enter into an options contract obligating you to sell your 100 shares of a stock at a predetermined price known as the strike price, usually higher than the current market price of that stock, by a certain date known as the expiration date. In exchange for signing this contract, you receive a premium which you get to keep.

If the stock does not cross above your strike price, then you get to keep the premium as well as not having to sell your stocks. The key benefit is you collect the premium just for obligating yourself to sell at the agreed strike price by expiration, even if the shares are not called away.

If the stocks move past your strike price your stocks may be called away however you get to benefit from the premium you had received plus the capital appreciation that you would be getting in selling the stocks at a higher price. So overall this is considered a win-win strategy.

There are some key tips and considerations that you should keep in mind with the covered call strategy which I am going to outline at the end.

How to Sell Covered Calls on Robinhood – Step By Step

Step 1

The first step is to open the Robinhood app and go to the page for the stock you have 100 shares of. In this example, I have more than 100 shares of AMD stock, so I will demonstrate using that. However, these same steps apply to any other stock you have at least 100 shares of.

The prerequisite for executing a covered call is that you must have at least 100 shares of that particular stock. If you do not already own the shares, you should first buy 100 shares of the stock.

There is another way to do a “naked” covered call, but that is a highly risky strategy that I do not recommend. For the purposes of this article, we will only cover the traditional covered call strategy, in which you must own 100 shares of the specific stock you plan to sell calls against.

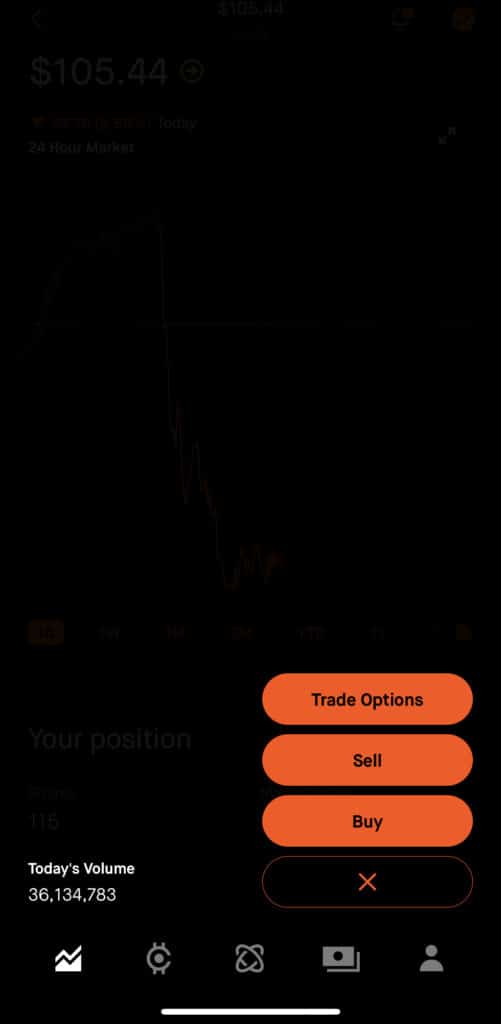

And then click on “Trade”.

Step 2

Once you click on “Trade”, you will be presented with three options “Trade Options”, “Sell” and “Buy”.

Click on the first option which says “Trade Options”.

Step 3

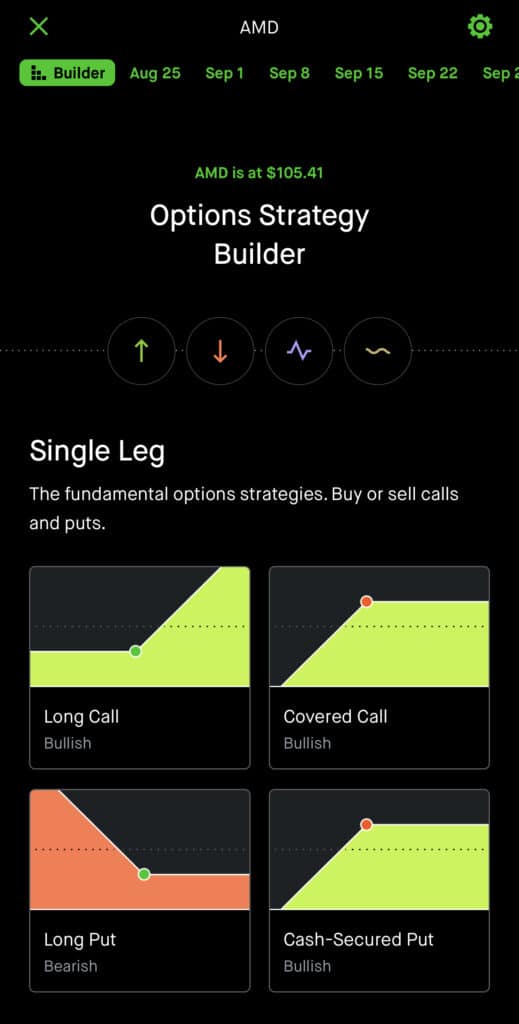

Now you will be presented with a screen as shown here. On the very top, you will see different dates. Those dates are the expiration date for the contract. In the case of AMD since it has weekly expirations you would see dates that spread weekly.

In a traditional covered call, it is usually best to select a DTE ( Date To Expiry) which is 30-45 days out. This is proven to be an ideal duration for an options contract.

So for this example, we will go with Sept 22nd which is about 30 days out. Click on the date that reads “Sep 22”.

Step 4

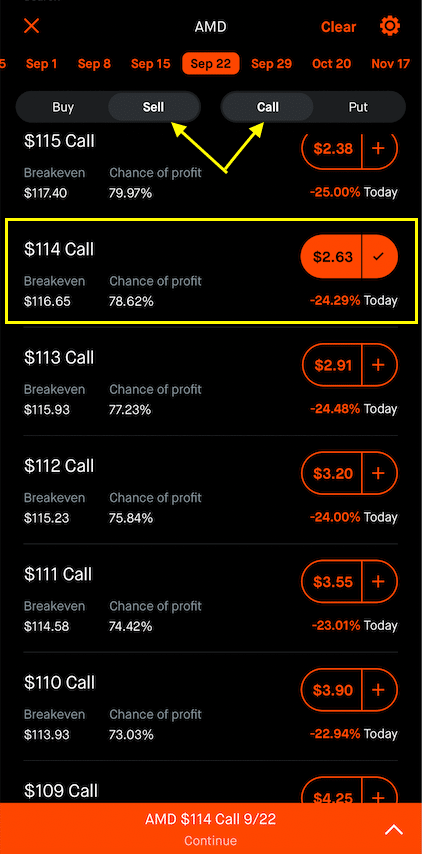

Once you click on the expiration date, you will be presented with the options chain for AMD. This will be listed according to strike prices on the left-hand side. You will see different strike prices, and on the right-hand side, you will see the premiums listed. So for a particular strike price, you can see how much premium you are getting.

You have to first select “Sell” and “Call” as shown by the arrow in the screenshot. And then you should choose a strike price for the covered call.

There are two things you should consider when choosing the strike price if you do not want to lose your stock:

- It is best to select a Delta which is closer to 0.3 or less.

- The strike price should be higher than your stock’s cost basis. I am selecting a strike of $114 in this example, as that is higher than my stock’s cost basis.

As you can see in the screenshot, for this I will receive a premium of $265. Remember, the premium is shown as $2.65, so you need to multiply that by 100 since 1 option contract equals 100 shares of the stock.

Step5

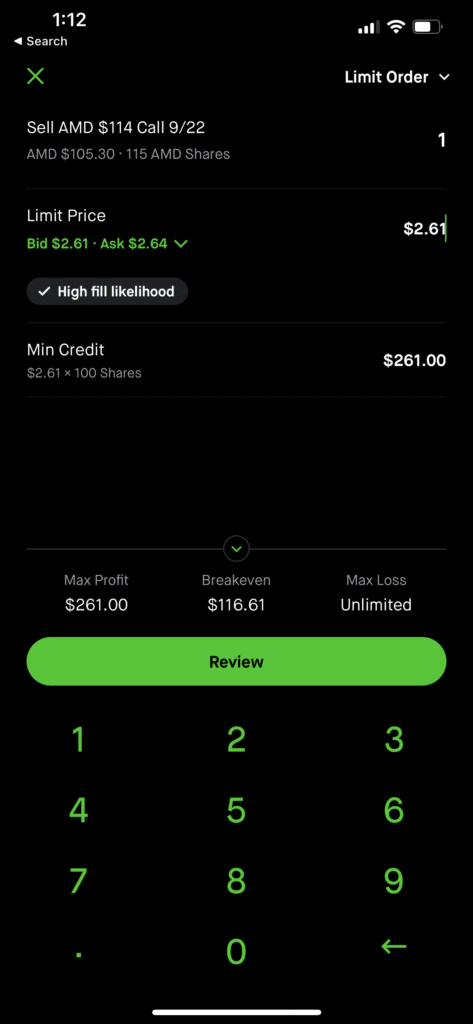

Once you select the strike price, the next step is to enter a limit price. You can either select a high price, the ask price, or something in between.

Usually, if you want to get your order filled immediately, you should go with the ask price. You can choose something in between, but note that it may take some time to fill your order. So it is best to just select the ask price to get your order filled immediately.

In this example, I have selected the Bid price as $2.61 which means I would receive $261 as a premium once the order is filled.

You can then click review.

Step 6

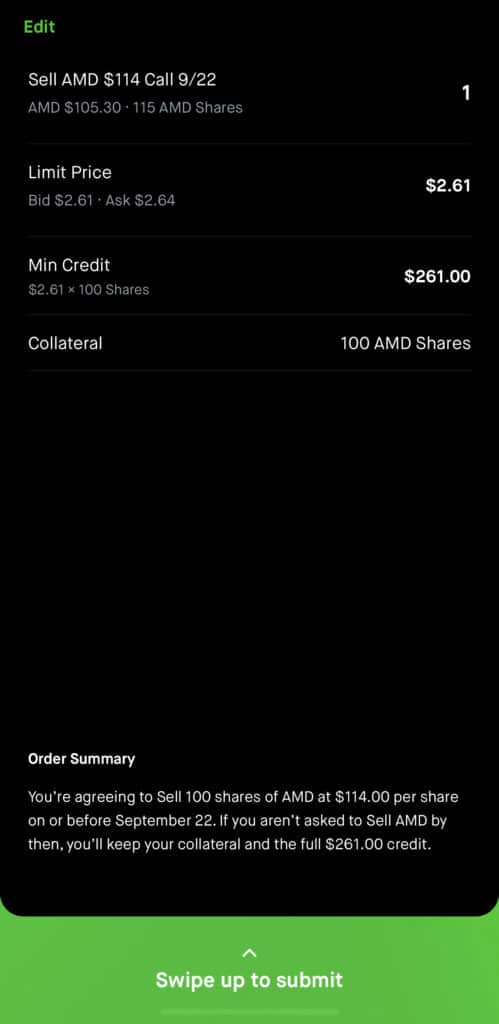

The final step is to review all the details. The first field here represents the number of contracts so in this case since we are only opening 1 option contract of covered call it says 1.

The next is the limit price for opening this contract.

And the final is the actual premium amount which is nothing but the limit price multiplied by 100 and multiplied by the number of contracts.

So for this example, it would be ( 1×2.61×100 = $261). If you had 2 contracts then your total premium received would become $522 ( $261×2)

Once you are good with the review. Swipe up to Submit the order. And that’s it.

Profit/Loss

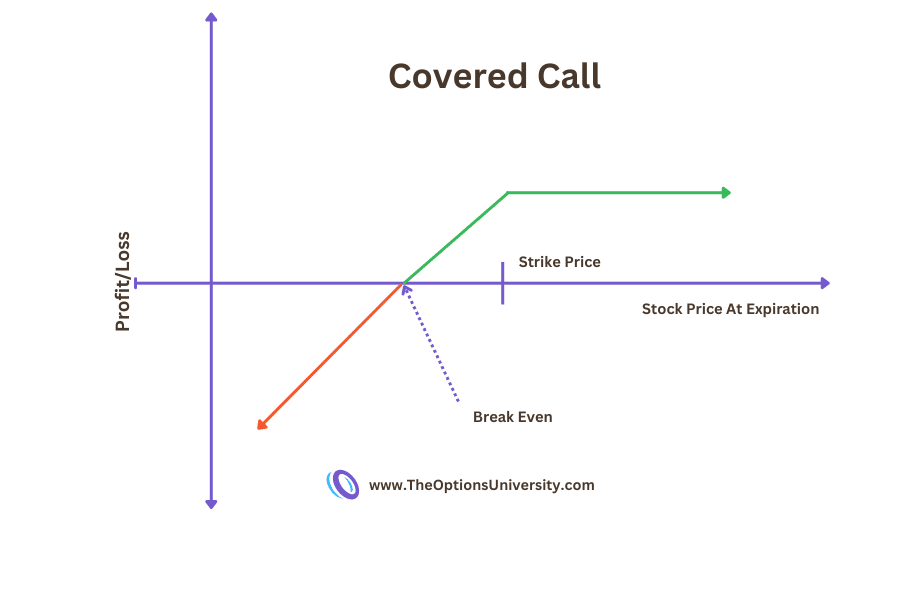

The profit and loss chart for a covered call would look something like the example below. You can see that your upside potential is capped, and that is equal to the premium amount you received.

So in our example, I will receive the $261 as a premium, so that is the max profit for this covered call. On the max loss side, the graph shows an unlimited loss. This is because if you are assigned, that means the strike price ends up below the stock price. In other words, the stock moves past your strike price and you are now In the Money.

Also Read

That is why max loss is shown as unlimited. Note that you would still gain any capital gain difference from the stock’s appreciation. For example, if you set a covered call at $114 and your cost basis is $110, you would get $400 off capital gains along with the premium you received.

Tips and Considerations

Although covered calls are a very good strategy to put your stocks to use and generate consistent income from stocks you already hold, there are some specific considerations and risks you should be aware of to become successful with this strategy. I am going to list them down point-wise:

The first is to always use this strategy with stocks that have good fundamentals and that you do not mind owning long-term in your portfolio.

The second is to choose a stock that is less volatile in nature and has a lower beta value. If they have a higher beta and are highly volatile, then you may have to keep adjusting your position or your stocks may get called away very soon, causing you to miss out on opportunities. This would become more painful as you have to re-access your overall positioning frequently.

Always sell covered calls at a strike price which is higher than your cost basis because there is always the risk of assignment and your stocks being called away. You don’t want to miss out on capital gains or at least don’t want to lose your stocks for less gain. So you should always plan your strike price accordingly so it is higher than your cost basis.

The final and very important point is to never try to sell naked covered calls. Some brokerage firms do allow naked covered calls but Robinhood does not. So even if you want to, you won’t be able to sell naked calls on Robinhood. But in general, if you are doing the covered call strategy on a platform that allows naked calls, never do that.

Final Thoughts

I hope you have gotten good value out of this article explaining how to sell covered calls on Robinhood. To conclude, I would say that covered calls are a fantastic strategy, especially for beginner options investors. You can generate consistent income using this strategy with stocks you already own in your account.

So if you have 100 shares of any stock, you can start applying this strategy and begin generating income. You just have to keep in mind the considerations and tips I have highlighted. You need to ensure you follow those guidelines to be successful in executing the covered call strategy.

If you have any questions feel free to comment down below or contact us via form. And you can send out questions to [email protected] as well.