Contrary to the belief of some, the stock market does not have to be a gambling place. There are strategic, calculated ways to generate consistent income from stocks that have nothing to do with just buying and holding and hoping for it to go up.

One of the best and safest options strategies that should be on every smart investor’s radar is the cash secured put, also known as a covered put. This strategy allows you to generate steady income week after week, even without owning the underlying stocks.

Cash secured puts enable you to get paid handsomely while obligating you to buy quality stocks at lower prices. The beauty lies in the consistent income you can collect while waiting patiently to purchase great companies.

In this article, we will explore why cash secured puts should be a part of every investor’s toolkit. We will also look at how to use them using one of the real-world examples. If you want to take your income investing to the next level, cash secured puts are a game changer.

Let’s dive in and see how they can supercharge your returns.

Why Sell Cash Secured Put?

The very first question that comes to mind even before getting into what it is and how to do it is What is the reason for doing it and how do you benefit from this?

There are two primary reasons investors utilize cash secured puts – to generate income or to acquire stocks at a desired price. With this strategy, you can tailor it to achieve one of those goals.

In this article, we will focus mainly on using cash secured puts to generate consistent income. While cash secured puts can also be used to acquire stocks at a discount, the examples here will optimize for income over acquisition. The concepts are the same, but the strike selection and expiration choices will differ based on your end goal.

The trades discussed in this article are best suited for maximizing income potential, primarily using non-dividend paying stocks. However, with some adjustments, the framework can also work for acquiring dividend stocks you wish to hold long-term.

What is Cash Secured Put?

A cash secured put is an income-generating strategy where you collect a premium and take on the obligation to buy 100 shares of a stock at a predefined price, known as the strike price, on or before the expiration date.

Let’s break this down further. There are always two parties in an options contract – the buyer and the seller. With a cash secured put, you are the seller of the put contract. This means someone is buying the put, betting on the stock to go down, while you are betting on the stock to go up.

By selling the put, you sign a contract obligating yourself to purchase 100 shares of the underlying stock at the agreed strike price anytime before expiration. In exchange, you receive an upfront premium which is paid by the option buyer.

If the stock drops below the strike price by expiration, you are obligated to buy at that set price. However, if the stock stays above the strike at expiration, the contract expires worthless and you get to keep the premium as profit.

Best Time To Sell Puts

There are a few key factors to consider when deciding the ideal time to sell puts on a particular stock or ETF.

First, the overall trend for the underlying security should be bullish or at least neutral. Selling puts is a fundamentally bullish options strategy, so you want the stock price to rise and end up above your strike price at expiration. Entering into a put position when the stock is in a downtrend would increase assignment risk.

Second, look to enter at a good technical support level when the stock seems oversold and due for a bounce. Selling puts after a drop to solid support provides an attractive entry point, as you expect the stock to trend higher from there. Avoid selling puts near resistance levels where the upside potential is more limited in the near term.

Overall the ideal times to sell cash secured put are when the stock’s technical chart shows a bullish/neutral trend and the price has recently pulled back to a known support area. This type of entry point provides greater upside potential and lower assignment risk, enabling you to collect income from oversold conditions.

Cash secured puts also used in conjuction to the call credit spread to form the popular iron condor option strategy.

How To Sell Cash Secured Put – An Example

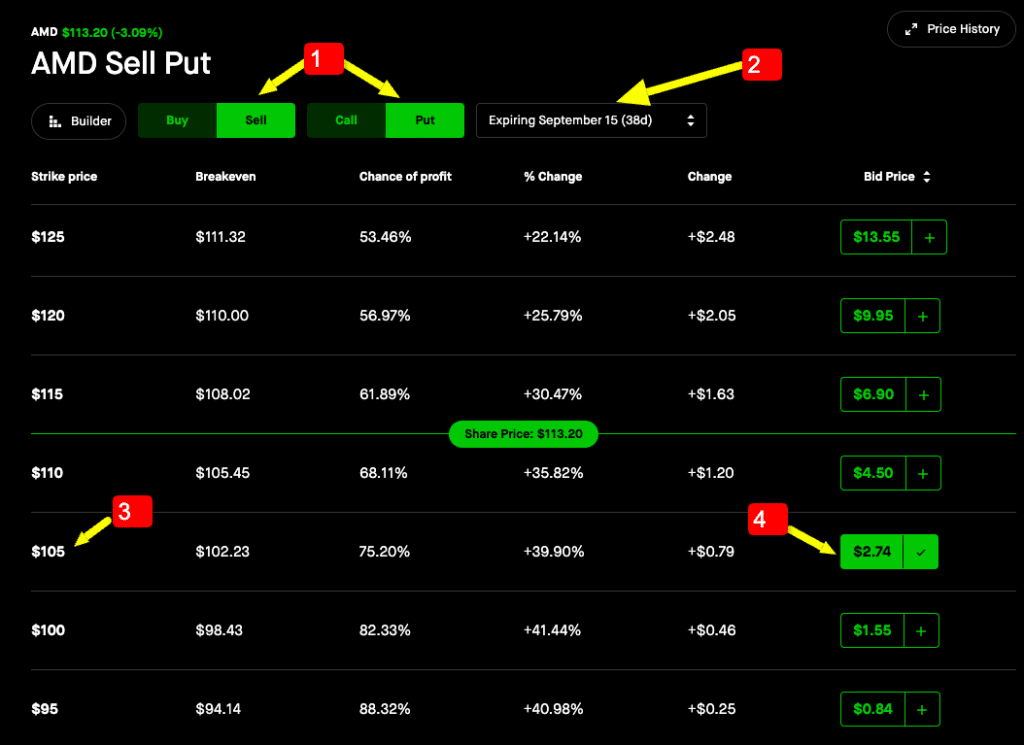

I am going to take the example of AMD stock and explain the steps involved in selling a cash secured put on the Robinhood platform. However, the steps and concept would remain very similar to any other brokerage platform. Here are the steps that you will have to take for selling a cash secured put.

Go to the options chain for the underlying that you would like to sell put on. Below is the current options chain of AMD. The current price for AMD is around $113 which is also called the spot price in options trading terminology.

Notice the key attributes on the options chain which are type of contract ( Buy/Sell – Call/Put), Expiration Date, Strike Price, and Premium.

Now you need to perform the following selection :

- From the contract selection choose “Sell” and “Put”

- Select an expiration date, you may choose a week out or a month out. You may end up receiving more premium if you do sell weekly put however that may require more management as well. If you sell monthly then you can set and forget for a month. The premium difference depends on a lot of other factors as well like earnings, dividends, etc. For this example, I have selected September 15th which is about a month out.

- Now choose a strike price, in general, you would like to select a strike price in which you are comfortable owning the stock in case you get assigned the shares.

- You can always check the premium. Remember options contracts are always on 100 shares basis so $8.55 means a premium of $855.

Now let’s understand our profit and loss equation for this trade.

The maximum profit for a cash secured put is straightforward - it equals the premium received for selling the put option.

In this example, the premium collected is $274.

The maximum loss for cash secured put is calculated by multiplying the strike price of stock by 100 and then subtracting the premium from that.

In this example, the maximum loss is calculated by taking the strike price of $105 and multiplying it by 100 shares per contract, then subtracting the $274 premium. This gives us a maximum loss of $10,226.

It’s important to understand this max loss figure does not represent an actual or realized loss amount. It simply signifies the total cash required if you get assigned the shares at $105. The maximum loss assumes you immediately lose all value on the 100 shares after assignment.

In reality, you would only incur the true maximum loss if AMD stock dropped to $0 immediately upon assignment at expiration. More realistically, even if assigned, you could see the shares appreciate or sell them at a loss better than a total loss. So max loss primarily represents obligation risk rather than likely loss amount.

Risk Of Selling Cash Secured Put

Although selling put is considered to be one of the safest options strategies that you can find when it comes to options trading. There are certain risks associated with it that you should be well aware of before entering into the options contract.

Pros And Cons

Here are some of the pros and cons of selling a cash secured put.

Pros

- Premium paid upfront

- The premium money could be invested elsewhere to make additional profit

- Theta decay works in your favor in a neutral movement

- Getting paid to own a stock at your desired price

Cons

- Upside potential is capped

- Early assignment risk on short call

- Adjustment may be required rapid stock movement

- Unrealized capital loss if stock falls after assignment

FAQ

In theory the max downside for a cash secured put is the total value of 100 stock minus the premium you received. The max loss is calculated assuming the stock goes to zero right after assignment. However practically the only downside to cash secured put is you are obligated to buy the stock at the strike price regardless of current market price of the stock.

Cash secured puts are considered one of the safest option strategies however it does carry some risk if the stock fell sharply and you are assigned the share at the strike price which is way below the market price.

Cash secured puts works best in a neutral to moderately bullish environment. If you expect underlying to move slightly or be in side ways movement you can generate consistent income using this strategy.

Practically the only downside of selling put is the stock assignment. If the stock goes below your strike price then you are obligated to buy the stock at the strike price.

And if market fell sharply downword then you will have unrealized capital loss on the stock.

Final Thoughts

To conclude I would say that if you are interested in generating some consistent income from the stocks then cash secured put is a fantastic strategy. It has potential to generate consistent weekly or monthly income without even owning the stock.

The only downside is stocks getting assigned however if you are not very far off from the market price of the underlying you can always mitigate this risk by using wheel strategy and sell covered call on the same.

Hope you have liked the article and got some value out of it. If you have any further questions you can always comment down below. I would be interested to know what is your favorite stock for this strategy.

You can always email at [email protected] as well for questions/comments.