As the market is starting to have a bullish trend in 2023, a lot of investors are now looking for bullish strategies around options that can be played to generate some quick gains out of their capital.

In this article, we are going to discuss the top five bullish options strategies that you can apply right away to generate growth in your portfolio, even if you have a small account.

There are strategies that I’m going to discuss in this article that will benefit you no matter whether you have a small or large account. So without further ado, let’s dive straight right into this.

Long Calls

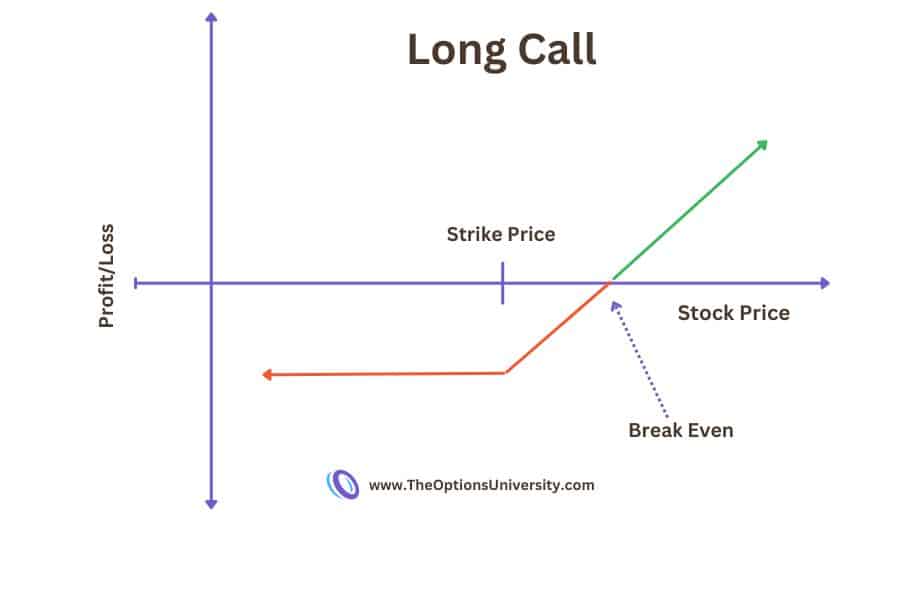

The first bullish options strategy that we will discuss is purchasing long-call options. This is a very basic strategy that many options traders use to exponentially multiply their profits. With long calls, you benefit from unlimited upside potential in the underlying stock, with the only risk being the amount you pay to buy the option.

The long call payoff chart has a slope upward to the right with the potential for unlimited profit for long as the stock price rises.

Long-call options provide a straightforward way to gain leveraged exposure if you are very bullish on a particular stock. However, you do need to keep implied volatility in mind, because if IV is too high, you are paying a hefty premium for the option, and time decay may erode some potential profits if the stock moves sideways instead of upward.

The keys to success are thoroughly analyzing the stock’s fundamentals, accurately determining if it will move favorably, and properly timing the entry into the long call position. If you are confident after research that the stock price will rise, long calls present the perfect strategy. Their inherent leverage provides the ability to easily double or even multiply your capital. But at the same time, this strategy can be risky, so it’s essential to only deploy it when completely convinced of the upside ahead.

Pros

- Unlimited upside potential.

- The downside is capped to the premium paid for the option.

Cons

- The probability of profit largely depends on quick upward stock movement.

- High Theta on shorter expiration dates can eat away profit even if the stock moves in a favorable direction

- IV Crush can play a crucial role

Bull Call Spread

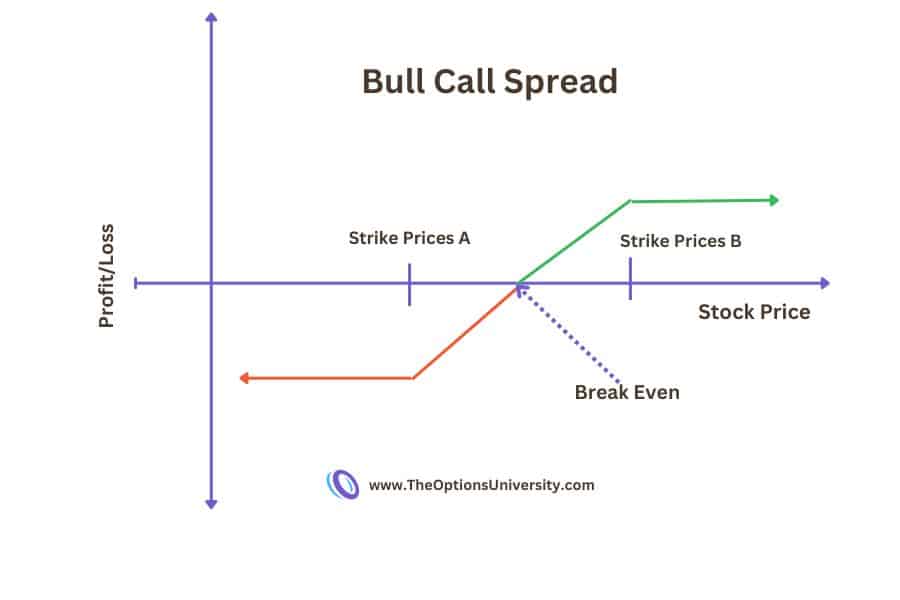

The second strategy is called Bull Call Spread also known as Call Debit Spread. This is a verticle spread strategy that also benefits from the stock moving up.

The strategy involves two legs where you buy a call option same as the long call but then you also sell a option at a higher strike price which offsets some of the premium that you paid to buy the call option. So overall you reduce your capital investment to get into the trade.

The downside to this is that your max profit is also capped, unlike the long call option which provides unlimited profit potential.

The chart for this slopes upward however unlike the long call option it flattens at the top since the max profit is capped.

Pros

- Less capital is required to enter the position

- Max risk is capped to the premium paid

- Benefits from the moderate rise in stock

Cons

- Limited profit potential

- Adjusting position could become tricky

- Early assignment risk on short calls

Bull Put Spread

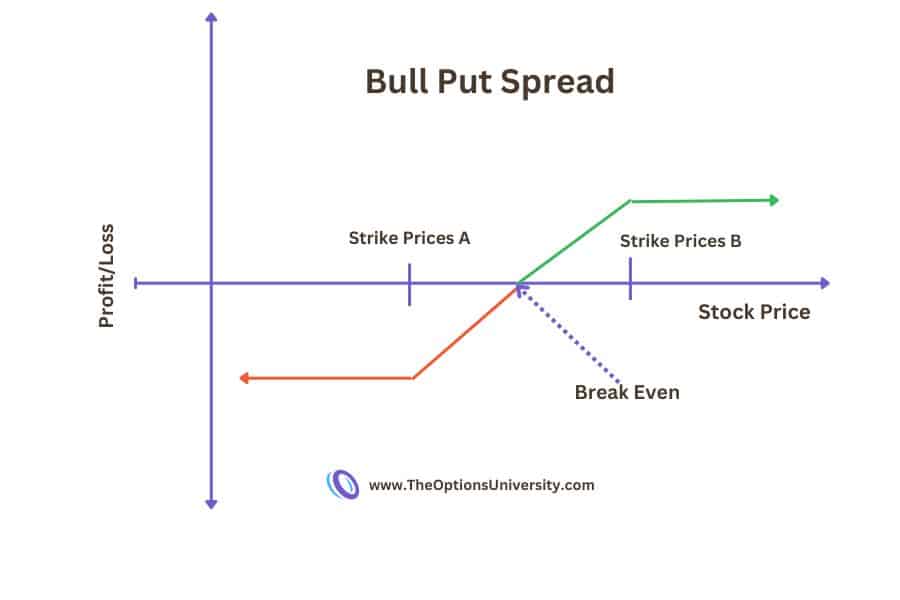

The bull put spread, also known as a put credit spread, is a bullish options strategy that puts limited capital at risk. It essentially utilizes a two-legged options position in which you sell a put option at a higher strike price closer to the money and then buy a put option further out of the money at a lower strike price. This creates a bull put spread and generates a credit when opening the position.

The collateral required to establish this position would be the difference between the strike prices multiplied by 100 shares per contract. For example, if you open a bull put spread with strikes at $105 and $100, then the total collateral required is $500 ($5 x 100 contracts). The $5 represents the spread between the strikes, and this amount would be multiplied by 100 shares per contract to determine the maximum risk on the trade.

The chart for this strategy will look very similar to Bull Call Spread. The slope on both the upside and downside is capped.

Pros

- Less capital is required to enter the position

- Max risk is capped to the premium paid

- Benefits from the moderate rise in stock

Cons

- Limited profit potential

- Adjusting position could become tricky

- Early assignment risk on short calls

Cash Secured Puts

Cash Secured Put is one of my favorite bullish options strategies that I use most often to get the stock at my desired price. In fact, many legendary investors like Warren Buffett also use the same strategy to get the stock at their desired price.

In this strategy, you essentially sell a put at a strike price that is below the current market price for that stock. You also collect a premium to get into this stock and for that, you are obligated to buy that stock at the strike price on/before expiration even if the current market price for that stock is lower than your strike price.

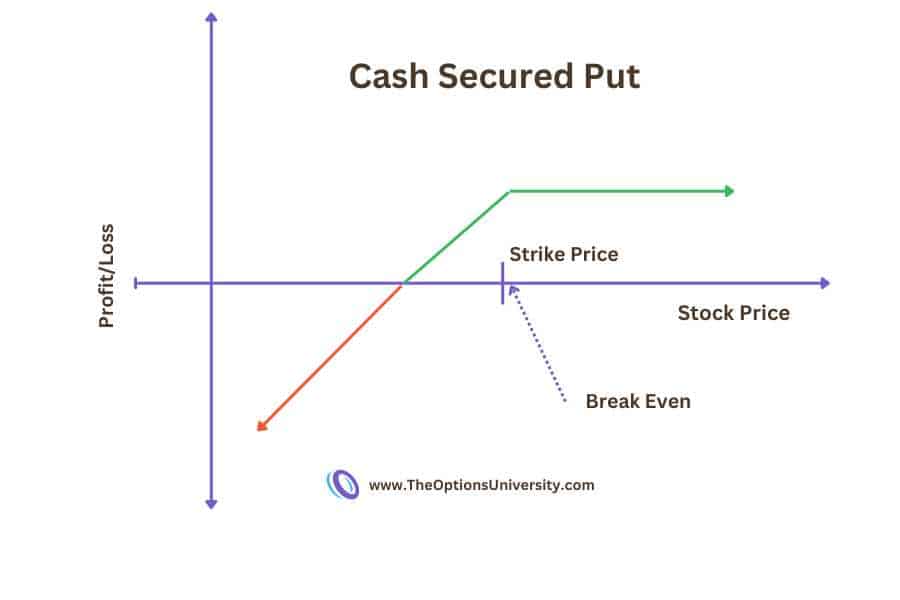

You profit from this strategy as long as the stock price stays above your strike price at the expiry. The max profit is capped to the premium you received and the downside risk is that you will have to buy the stock at the strike price. ( Which again technically wouldn’t really be classified as “risk” since you are not losing any money. you are just buying a stock at the strike price. )

The chart for cash secured put will have a straight line beyond the strike price which represents the capped profit. On the downside, it has an unlimited loss ( Again technically it is not a loss just the stocks assigned to you) which you can apply the wheel strategy if you want to get rid of the stock at your desired price.

Pros

- Premium paid upfront

- The premium money could be invested elsewhere to make additional profit

- Theta decay works in your favor in a neutral movement

- Getting paid to own a stock at your desired price

Cons

- Upside potential is capped

- Early assignment risk on short call

- Adjustment may be required rapid stock movement

- Unrealized capital loss if stock falls after assignment

LEAPS

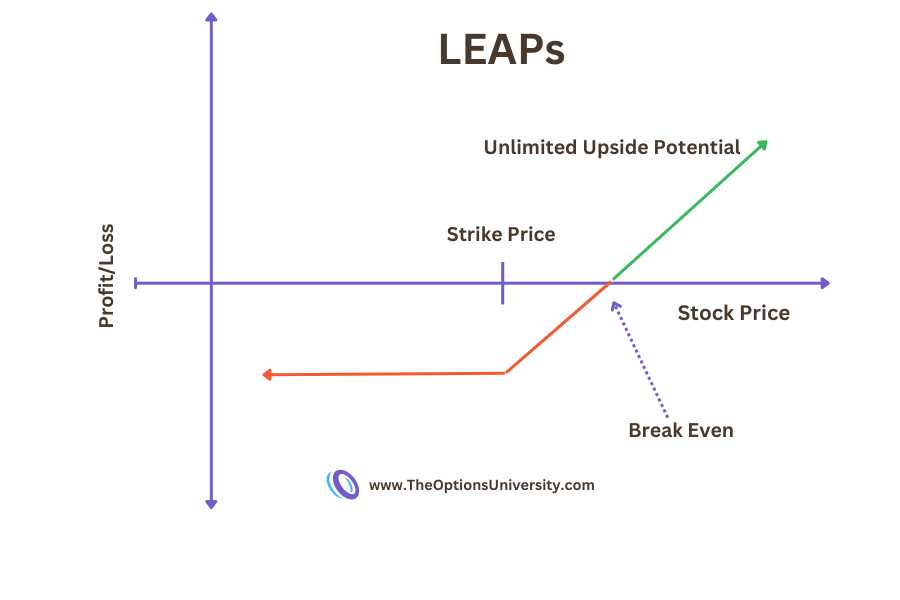

The final popular bullish option strategy is LEAPS (Long-Term Equity Anticipation Securities). From a profit/loss perspective, LEAPS functions similarly to long calls but with two key differences – longer expiration dates and deeper in-the-money strike prices.

LEAPS are long call options with expiration dates farther out, usually at least one year into the future. Their strike prices are chosen deep in-the-money, typically with a delta of around 0.7 to 0.9.

LEAPS are often compared to owning 100 shares of the underlying stock outright but with less capital required upfront. The position essentially provides leverage over your invested capital. Purchasing LEAPS with deltas near 0.8 or 0.9 can provide profit/loss exposure same as owning the equivalent shares of stock, but only requiring payment of the option premium.

The payoff diagram will appear similar to a long call, with the upside sloping upward representing unlimited profit potential, while downside risk is limited to the initial debit spent on the LEAP option.

Pros

- Limited downside risk

- Unlimited upside potential

- Provides leveraged over money

- Less expensive than owning stocks

Cons

- This can result in a 100% loss if the stock does not move in the expected direction.

- Theta decay can eat away at profits

- Lacks dividends compared to owning stocks

Final Thoughts

In summary, the bullish options strategies discussed can each help generate profits during upward market moves. And these approaches should only be applied if you have a genuinely bullish outlook on a particular stock, as that is the optimal context to maximize its profit potential.

I hope you have gained useful insights from this overview of popular bullish option trading tactics. Please feel free to provide any feedback or questions in the comments section below, or you can reach out directly via email at [email protected].