In today’s markets, generating steady passive income is top of mind for many investors. One options trading strategy that can help you earn an extra monthly income is called a covered call strategy.

A covered call allows you to earn money from options you already own. It involves selling call options against shares of stock you hold to collect premium income. This article will explain what covered calls are, the benefits of using them, and provide an actionable covered call strategy to start generating passive cash flow.

If you are new to options trading then I would encourage you to go through the basics of options trading first which will give you a complete idea of how to start trading options.

So without further ado let’s start on this strategy.

What Is the Covered Call Strategy?

A covered call is an options trading strategy where an investor already owns the underlying stock and sells (writes) call options on that same stock. Since the investor has the obligation to sell the shares at the strike price if the call option is exercised, the calls are “covered” by the underlying shares they own.

For example, you might already own 100 shares of XYZ stock. You could then sell one call option contract, giving the buyer the right to purchase those 100 shares from you at a specific price (strike price) before the call expiration date.

You can do this weekly/Monthly or there are some ETFs like SPY or QQQ that allow you to sell covered calls for even shorter duration.

The premium you collect from selling the call option is the income you generate. Even if the shares are called away from you, you still keep the premium. This provides downside protection and creates an ongoing income stream.

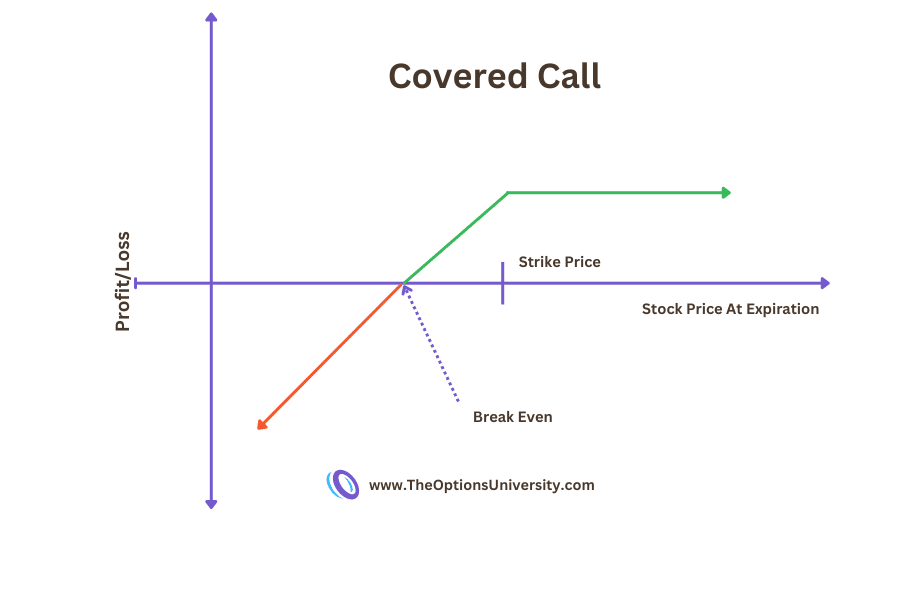

The chart covered shows a straight line indicating the limited profit that you would receive in the form of a premium. And in the opposite direction, it depicts unlimited loss ( which technically only means that your stock will be called away).

Key Benefits of Using Covered Call

Low Risk and Max Profit

The primary benefit of selling covered calls is the ability to generate income while limiting your risk exposure. By selling a call option against your shares, you are protected from adverse movements in the stock price.

Even if the stock price skyrockets, you won’t be obligated to repay the buyer of the call because you have the shares to fulfill the transaction. This is why covered calls derive their name from the fact that the calls are covered by the underlying shares.

Covered Call Strategy For Income

Warren Buffett, one of the world’s most successful investors, also generates consistent income by using a covered call strategy. This strategy aligns perfectly with his philosophy of collecting income from his investments. Selling puts is another income-generating strategy endorsed by Buffett.

Selling covered calls is a powerful tool for increasing your overall wealth. You will be surprised to know that many investors still fail to take advantage of this strategy. By mastering covered call options, you can secure a market return or even achieve an above-average return.

Also Read

Whether you prefer weekly or monthly income, selling covered calls provides a steady stream of cash flow. It’s a strategy that can be pursued for a lifetime, allowing you to enjoy the benefits of increased income and financial security.

Passive Income Using Covered Call Strategy

As we discussed, one of the most important aspects of selling covered calls is the opportunity to earn passive income effortlessly.

By leveraging your existing stocks, you can transform them into income-generating assets. Similar to dividends, the premiums you collect from selling call options provide you with regular income. With careful stock selection and strategic execution, you can achieve consistent weekly or monthly cash flow, regardless of your portfolio size.

Hedging your Portfolio Using Covered Call

Another big advantage of why I would use a covered call strategy is hedging. Perhaps you’ve heard the phrase “hedging your bets” before. Selling covered calls is a real-life example of hedging in the stock market.

Even if a stock you own experiences a decline in price, you still benefit from this strategy. When you sell a call option and collect a premium, you mitigate some of the potential losses. Let’s say the stock falls by 10%, but you collected a 5% premium from selling the call. In this scenario, while the stock investor faces a 10% loss, your loss is only 5%. By using covered calls, you can effectively limit your downside risk.

To further minimize risk while implementing the covered call strategy, you have the option to focus exclusively on ETFs such as SPY or QQQ. And by doing so, you safeguard yourself against any adverse news or earnings reports that might adversely affect individual stocks in your portfolio.

Flexible Risk Management

One of the advantages of a covered call strategy is the flexibility it provides for managing risk based on your personal tolerance and investing goals. When selling covered calls, you can customize several elements to either increase potential income or reduce possible downside risk:

Strike Price Selection – Choosing lower strike prices that are closer to the stock’s current value results in higher premium income but increases the chance of having the shares called away. On the other hand, higher strike prices yield lower premiums but reduce the likelihood of assignment. You may choose a strike price based on your risk appetite.

Expiration Date – Another element to play around with is the expiration date. Shorter expirations of 1 month or less earn higher premiums but come with a higher risk of stock price movements. Longer-dated calls of 3-6 months offer greater protection from downward price swings but limit income potential.

Number of Contracts – Selling more covered call contracts generates higher income but exposes you to greater assignment risk if the stock rises sharply. Limiting contracts reduces potential earnings but caps your downside if shares get called away.

Diversification – Spreading covered call trades across multiple stocks and sectors mitigates company-specific risks. Concentrating too heavily on one area increases sector-specific risks.

Steps to Execute a Covered Call

To start utilizing covered calls, follow these simple steps:

- Buy Shares of Stock

First, purchase shares of a stock you want to generate income from. Make sure it’s a company you don’t mind holding long-term. You need 100 shares for each call contract you sell.

- Sell Out-of-Money Call Options

When you’re ready to create income, sell one or more out-of-the-money call option contracts above the current stock price. This gives you premium income while allowing upside until the strike price.

- Collect Premium Income

The premium income from selling covered call options is immediately deposited into your brokerage account. This can provide steady passive earnings.

- Manage the Trade at Expiration

As expiration approaches, you have three choices:

- Buy back the call to close the trade and keep all income and shares

- Let the call expire worthless so you profit from the income and retain shares

- Get assigned on the call if it’s in the money and sell your shares at the strike price.

FAQ

A Covered call is one of the option trading strategies where you put your stocks as collateral and sell a call against them to generate income in the form of a premium. It is considered one the of safe strategies in options trading.

Yes, in general selling covered is considered a low-risk strategy to generate consistent income. And selling a covered call against ETF compared to stock is even safer as you safeguard yourself against any adverse news or earnings reports that might adversely affect individual stocks.

A covered call is a low-risk strategy where you generate consistent income. The upside per trade is capped in case of a covered call and hence you may not make a lot in a single trade however if you do it consistently then this is a very profitable option strategy.

Follow these simple steps to execute a covered call strategy:

1. Purchase a minimum of 100 shares of a stock you believe in and want to hold.

2. Use your stock by selling a call option to someone willing to bet on the stock’s price rising.

3. As the seller of the call option, you receive a premium for taking on the obligation to sell your shares at a higher price if the stock reaches the strike price.

4. Enjoy the added income generated by the premium while retaining the ownership of your stock.

Final Thoughts

Personally selling covered call and selling puts are two of my top option strategies that I use to generate consistent weekly and monthly income from stock. Covered call strategy is an incredible strategy that allows you to earn additional income from the stock that you already own. And if you are not taking full advantage of this strategy then you are literally leaving money on the table.

Covered call is very low risk strategy that allows you to leverage your existing shares and generate regular cash flow. By mastering this technique, you can easily surpass the overall market return percentage.

Hope you have gained some value from this and if you have any further question around this please leave a comment down below or email us at [email protected].