A put credit spread is one of the best option strategies for growing a small account. In this article, we will discuss when and how to close put credit spread position, also known as a bull put credit spread, on Robinhood step-by-step.

I will divide this into three categories and discuss how you can close the position if it is in the money (ITM), out of the money (OTM), or at the money (ATM). We will go over how to best manage the position in each of these situations.

Everything will be explained in a detailed, step-by-step manner in this article. So without further ado, let’s get started.

Quick Overview of Put Credit Spread

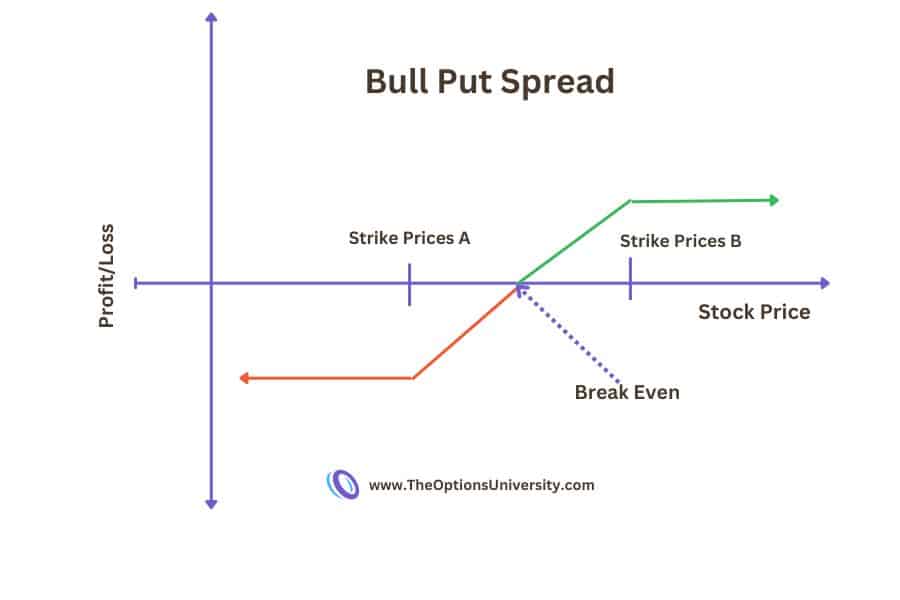

Put Credit spread also known as bull put spread is one of the popular options trading strategies out there. It is executed by selling a put at a strike price which is below the current market price of the stock and then buying a put below the sell strike price to make it a spread. And you receive a credit premium for this position since the amount you pay to buy the put would be lower than selling a put which is closer to the spot price of stock.

The DTE ( Date to Expiry) traditionally is kept between 30 to 45 days out in future and the delta should be less than .20.

However this is only a general guideline and depending on the stock performance, market sentiments and technical analysis this can vary for individual stocks/ETFs.

The primary purpose of a put credit spread also known as bull put spread is to generate consistent income in the form of premium received for the trade.

The upside profit potential and downside risk both are capped in this trade as you can see from the profit/loss chart. You keep 100% profit if the stock expires above your short put strike. And your max loss would be the width of spread subtracted by the premium received.

When to Close Put Credit Spread

We can primarily divide the situation in three different category on when to close out the put credit spread. The options available and the action needed differs based on whether the trade position is In the money (ITM), At the money (ATM) or OTM (Out of the money).

We will discuss next what you can do in each of these situations.

Out of The Money (OTM)

This typically happens when the current stock price ends up higher than your short strike price at the expiry. This is the most favorable condition that you would like to see as a Put Credit Spread position holder.

Example if you sell a Put credit spread on Apple (Ticker: AAPL) with $170/$165 strikes and the stock price of apple is more than $170 at the expiry. Both the sell and buy put positions expire worthless and you get to keep all the premium received.

So in this situation you may do one of these things:

Let Contract Expire Worthless: This is the best case scenario. Typically you don’t do anything at all, just let the contract expire worthless. Your broker will automatically close the positions. And you keep all the premium you had already collected.

Close Position Early: The option you have is to close the position early. You may choose to close early to collect remaining premium. You do not have to wait till the expiry to close the position. Typically I would say that if you are already 80%+ on the returns with only few days left to expiry you can go ahead and close the position.

At the Money ( ATM)

This typically happens when the current stock price ends up about same as your short strike price at the expiry. You may need some adjustments to the position in this situation.

Taking the same example, if you sell a Put credit spread on AAPL with $170/$165 strikes and the stock price of apple is approximately hovering around $170 closer to the expiry. You most likely will have a positive return on this position due to very less extrinsic value left on the option premium.

In this situation you can choose to do one the following:

Close Position Early: If you are near expiration and your short strike is getting tested, it is typically best to simply close out the position. At that point, you will have already gained some premium value from theta decay, and there will be less remaining value left. If you have a 60-70% gain on the position, it is a good idea to close it out and move on to a different trade.

Roll Before Expiration: The other option you have is to roll out the complete trade to further out DTE. This way you are giving more time for the trade to play out in your favor.

Also Read

Depending on how the other greeks are placed you may be able to collect some extra credit as well on the premium for doing so. You would want to do this if there is still a lot of extrinsic value left and you don’t believe that stock is will in your direction in coming days/weeks.

In The Money ( ITM)

This is the situation that you absolutely do NOT want to be in. ITM happens when the stock price drops below your short strike or below both short and long strike.

Taking the same example, if you sell a Put credit spread on AAPL with $170/$165 strikes and the stock price of apple is goes below $170 or $165 anytime before the expiry your position is In the Money.

You will be at a partial or at max loss situation in this case. There are couple of things however you can do to save yourself from the loss by adjusting the trade accordingly.

Close the Position: If you believe that your thesis on the underlying has completely changed because of your research or any news then it is most of the time to just take the loss and move on to different trade instead of scrambling to save the trade.

Roll the Position Out in Time: Similar to At the Money solution you can always roll your position out to a future expiry. Depending on how far you move it you may be able to do it for a credit as well.

My only suggestion would be to do this if you think that underlying prices would improve with time and this is only a temporary price fluctuation and there is a fundamental change in your research about the company.

Roll the Put Credit Spread down in Strike: Instead of going out in time you may also roll the put credit spread further down which could eat up your premium received but you will have better probability of winning if stock bounces back.

Buy buy the short put : This is another way to cut losses on your trade. You buy back the short put and let the other strike ride till expiration. In this case, you lose the credit received but this locks in the maximum loss on the long put. And it requires no further capital to hold to expiration.

Step By Step Walkthrough In Robinhood

Now lets take a concrete example from Robinhood and walk through each of the scenarios that we discussed above.

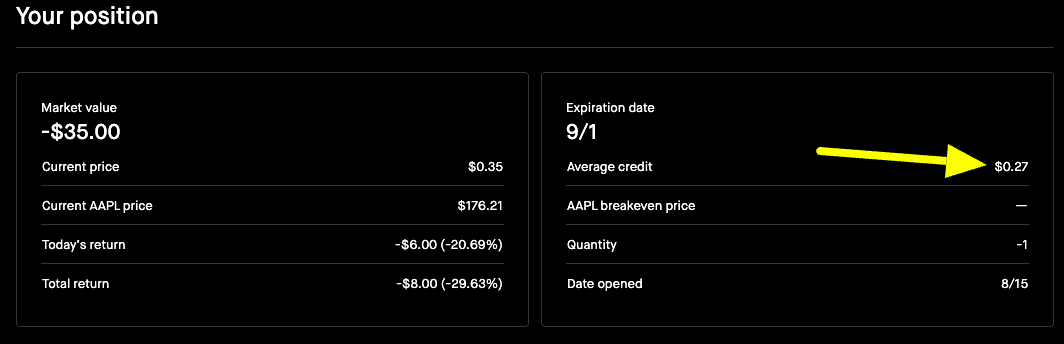

Below is an example of put credit spread on AAPL stock ( $170/$167.5) strike.

The Premium received to open this bull put spread was $27 as you can see in average credit field below.

This put credit spread position is made up of two legs. As the current Apple stock price running is about $176 so $170 is the short strike and $167.5 is the long strike.

The DTE is September 1st. Now lets take the three possible cases about OTM,ATM and ITM and see how you would adjust the position in Robinhood platform for each of them.

Case 1: Out of the Money ( OTM )

Assuming Apple stock is at $175 on Sept 1st , this trade will be considered OTM. You don’t have to do anything in this case and you can let both above contracts of Sell Put $170 and Buy Put $167.5 expire worthless. You will retain the full premium of $27.

Case 2: At the Money (ATM)

Assuming Apple stock is at $170.68 or around $171 on Sept 1st , this trade will be considered ATM. To be safe in this situation your best bet is to close the spread for some profit. You may have to pay some of the premium back to close so instead of $27 your net profit could be $24/$22.

However, you will not have any risk of assignment or loosing the complete collateral if it ends up closing below your strike at the market close. Hence considering the risk/reward ratio it is best to close the spread which is ATM.

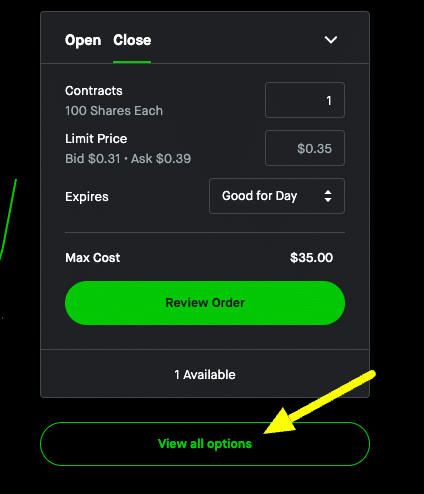

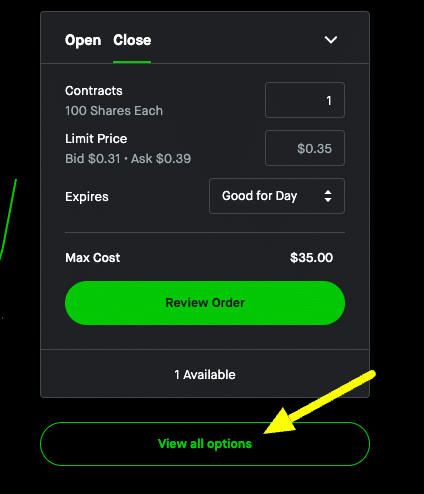

To close the position in Robinhood, there are two ways. Either you can simply go to the position and select close, enter the price and complete the transaction. You see a higher price below in bid-ask and that is because this screenshot is taken on Aug 16th and there is still 2 weeks left on expiry.

As you get closer to the expiry and as long as Apple price stays above your short strike of $170 theta decay will eat away the extrinsic value which in turn will decrease the cost to close the spread.

The other way to close the position is by doing the things individually.

Step 1: You first click on “View all options”.

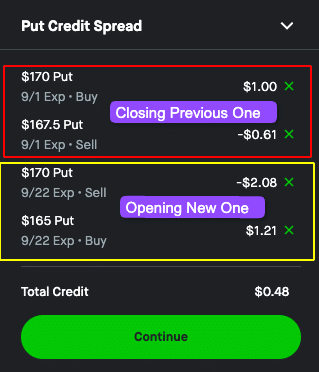

Step 2: And then do the reverse of what you did to open the put credit spread. So basically you buy back the short put and sell the long put.

Both options does the exact same thing. In the first option Robinhood just makes it easy by doing it automatically and it second option we are doing it ourself by individually adjusting both the option legs.

Case 3: In the Money (ITM)

Now assuming apple stock gets dropped to $160 which would be below both your strike prices. In this case your position will be In the Money and you are technically at the max loss condition.

For this case as we discussed previously, first option would be to simply close the spread for loss. You can close the same way we discussed in ATM. The only thing is you will have to pay the cost to close the position and that would be equal to your collateral minus the premium received.

The other options are to roll out to future expiry or roll down in strike price. You can do this by clicking the “View All Options”. This will navigate you to the options chain.

Now you first have to close the previous spread and then create a new one by choosing a expiration date which is further out. You can choose for example in late September or October to allow the trade 30 more days to play out in your favor.

Depending on the greeks you may be able to roll out for a credit as well. The Robinhood platform will show you if it would be a Credit/Debit after your selection.

Your final order should look something like below. In this the previous position is closed and a new position is open with a future DTE.

Summary And Key Takeaways

To conclude, I would say put credit spread is a fantastic options strategy to grow a small account. And closing or rolling out the put credit spread position is fairly straightforward in Robinhood platform. As a beginner it may seem slightly complex at the beginning but once you execute few trades you will get familiar and it becomes easier.

The more important aspect is to be aware of all the possible cases that may occur and take the appropriate decision to adjust the position.

The goal should be to avoid any losses if the trade does not go according to the plan.

Hope you liked the article and gained some value out of it. If you have any questions you may comment down below email at contact@theoptionsuniversity.com. If you prefer a video tutorial format you can always checkout my youtube channel.