Iron condors are one of the best options strategies for generating consistent income, especially when applied to the S&P 500 Index (SPX). By executing the SPX iron condor strategy, you can optimize the probability of profitability and achieve reliable weekly or monthly income.

In this article, we will briefly discuss what an iron condor strategy is, the main merits of it, and then take an example trade on SPY – the ETF that closely tracks the SPX movements – to demonstrate step-by-step how to execute iron condors in a very optimized manner.

Walking through a detailed example on SPY will allow us to see how to structure, manage, and close out iron condor spreads on the SPX for consistent profits. Whether you are just starting on to options trading or a seasoned veteran, this deep dive into executing optimized iron condors can help refine your approach to this high probability strategy.

If you are a complete beginner on the options trading then I may suggesting going over options 101 which will introduce you nicely on the ins and outs of the options.

So without further a due lets get started.

Brief Overview of Iron Condor Strategy

An iron condor is primarily comprised of two separate credit spreads – a bull put spread also called put credit spread on the put side and a bear call spread also called call credit spread on the call side. In other words, an iron condor combines a put credit spread with a call credit spread. This makes the iron condor a fundamentally neutral strategy that benefits when the underlying stock trades sideways.

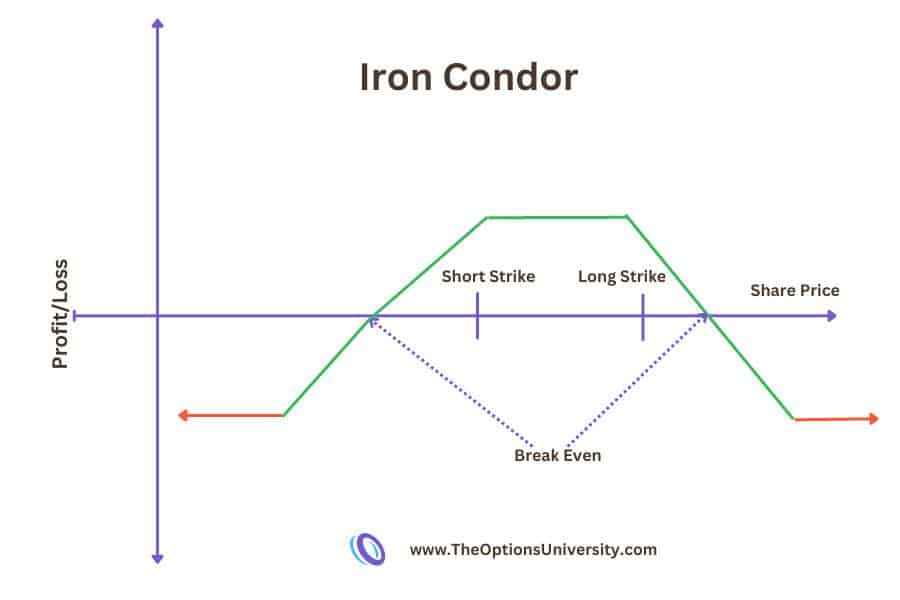

You gain maximum profit from an iron condor when the stock price remains between the lower strike price of the put credit spread and the higher strike price of the call credit spread at expiration. As long as the stock stays between these two strikes and does not cross either side, you stand to benefit the most from the iron condor trade. The key is structuring the put and call credit spreads far enough apart to accommodate neutral or sideways price action in the underlying stock.

Also Read

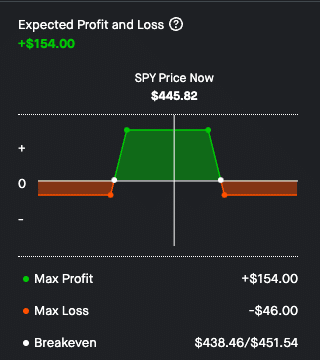

As you can see in the chart below, the iron condor has a clear profit and loss profile. You achieve maximum profit if the underlying stock trades sideways within the wings of the iron condor through expiration. However, if the stock drops below the lower strike or rises above the higher strike, you begin losing money on the put or call side respectively. Still, your maximum loss is defined and limited due to the credit received when opening the iron condor.

You can adjust the width between the put and call strike prices based on your market outlook. A wider iron condor costs less to open but provides more protection in case the stock makes a larger move up or down. The narrower you make the strikes, the more premium you collect upfront but the lower the probability of remaining profitable. Based on your risk tolerance, you can structure the iron condor strikes appropriately to match your forecast and meet your profit goals.

Why Iron Condor on SPX/SPY?

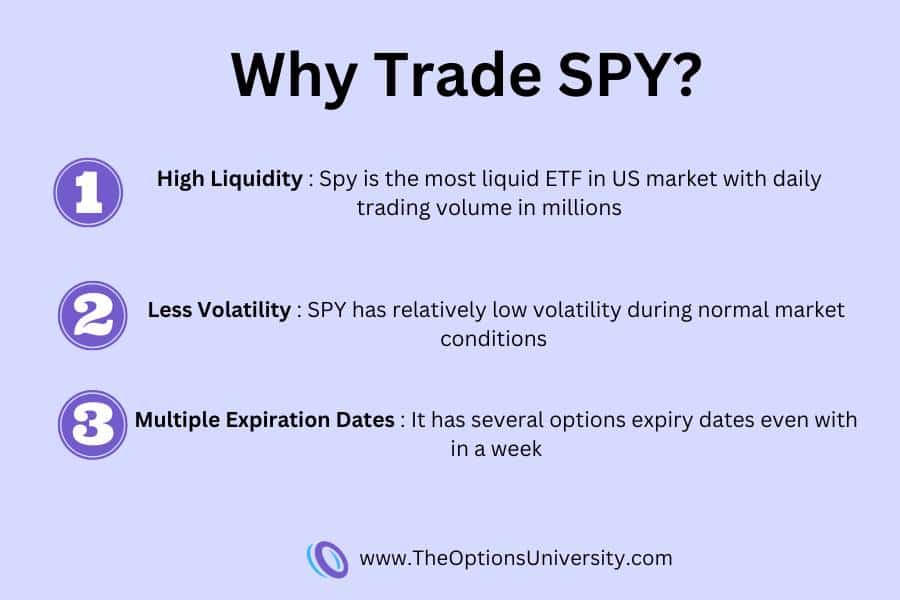

The S&P 500 (SPX) ETF tracker ( Ticker: SPY) is one of the most popular trading vehicles in the US stock market. There are some key characteristics that make SPY a highly desirable choice for trading iron condor options strategies. It has high liquidity, low volatility, and multiple expiration cycles – three traits that perfectly aligns with SPX iron condor strategy.

SPY is an extremely liquid and heavily traded ETF on the exchanges. This high volume and tight bid-ask spreads make entering and adjusting iron condor positions much easier.

SPY tends to have relatively low volatility during normal market conditions outside of major events. This neutral price action keeps keeps SPY in a range bound action and that aligns well with the profitability of Iron Condor Strategy.

Also, SPY offers multiple options expiration dates even within a single week. This flexibility allows iron condor traders to more effectively manage adjustments if the trade doesn’t go in their favor. With SPY having multiple expirations, it is easy to roll or modify positions to defend or optimize a trade.

SPX Iron Condor Strategy – Step By Step

Now lets look at how you can execute the SPX iron condor strategy. There are primarily two legs in executing the iron condor strategy.

Leg 1 : Put Credit Spread

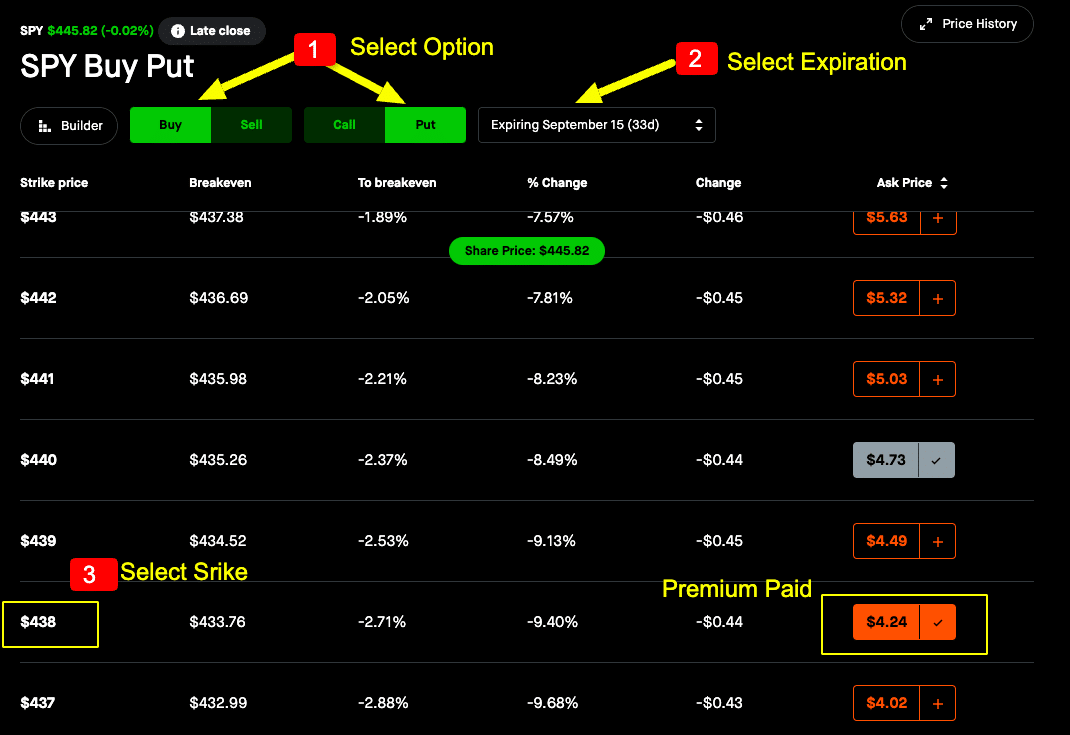

The first part is to setup the put credit spread leg which involves selling a put closer to the money and then buying a put at a strike further out of the money.

The first leg of an iron condor starts with a put credit spread. The first thing you need to do is select “Sell” and choose puts for the options. Next, select an expiration date around 30-45 days out. It’s best to go with a date about a month away. Then, choose a strike price close to the money. With SPY currently trading around $445, select a strike around $440, which is about 30 delta.

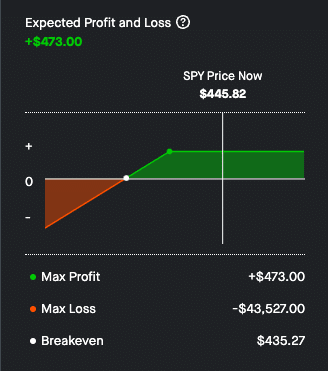

For this position, you would receive a premium of $473.

At this point the profit and loss diagram would look like below where your max gain is equal to the premium received however you have a much higher max loss equal to the value of 100 shares of SPY minus the premium that you have received.

So next thing you need to do is select “Buy” and choose “Put” for the options. Then, choose a strike price further out to the money. This will decide the width of the iron condor. As an example we select a strike price of $438 which will give a width of $200 dollar. This is because we are going 2 strikes down and multiply that by 100.

This completes the leg 1 of iron condor and the profit and loss at this point would like below. We have basically capped our max loss and now thats only equal to the width of the strikes minus the premium received.

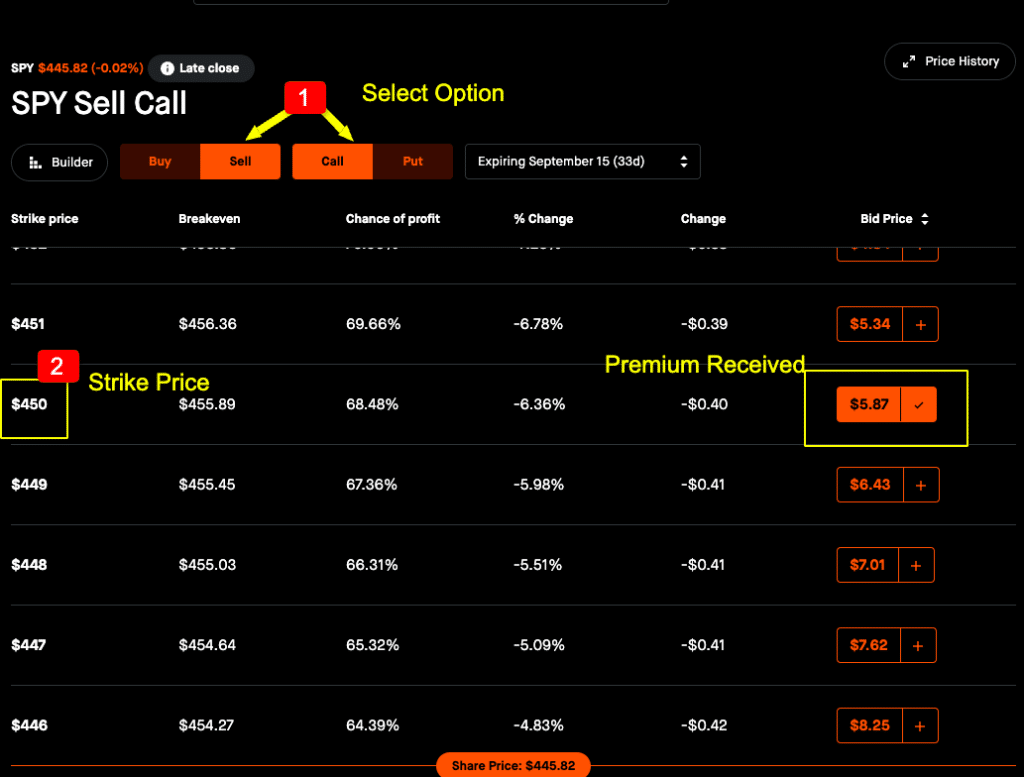

Leg2: Call Credit Spread

The second leg of an iron condor starts with a call credit spread. The first thing you need to do is select “Sell” and choose “Call” for the options. Keep the expiration date same. Then, choose a strike price close to the money. With SPY currently trading around $445, select a strike around $450 which is 5 points higher than spot price. You may go further out as well to be extra safe. The strike selection mostly depends on your risk profile. The closer you are to the strike the more chances of the position go In the money however you get to collect more premium.

On the other hand the further you move out from current market price the probability of contract getting expired worthless is higher but you get less premium for that. So the goal is to strike a balance between these two aspects.

For this position, you would receive a premium of $587.

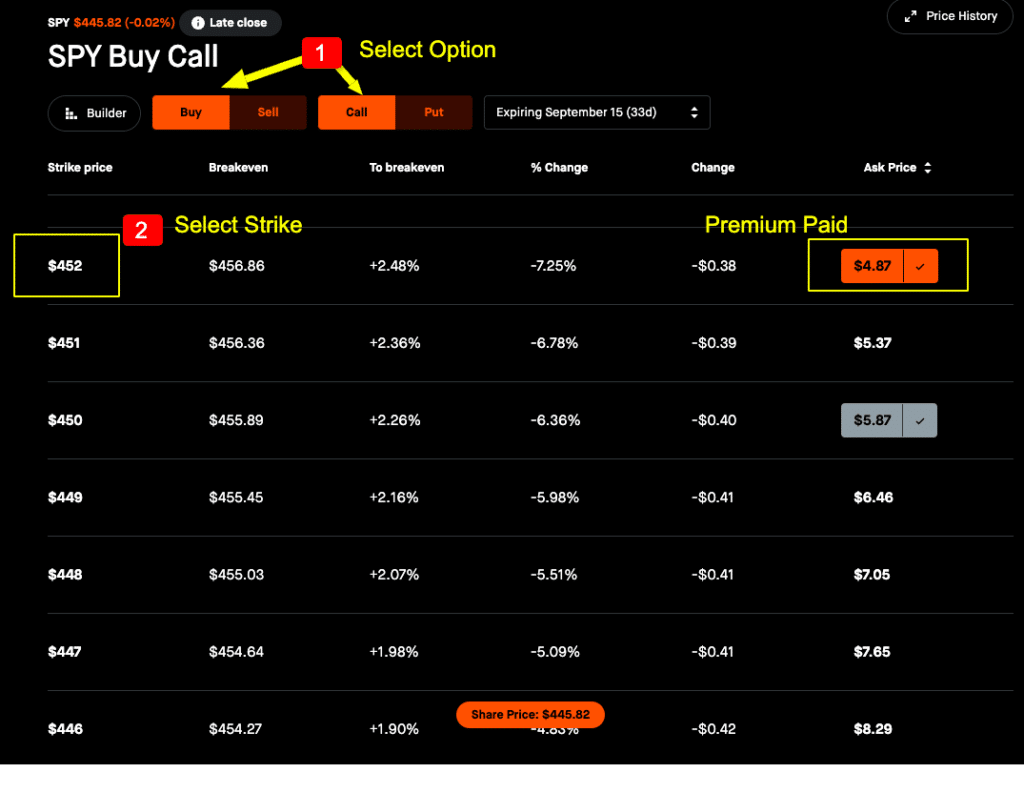

Next thing you need to do is select “Buy” and choose “Call” for the options. Then, choose a strike price further out to the money. This will decide the width of the iron condor. As an example we select a strike price of $452 which will give a width of $200 dollar. This is because we are going 2 strikes down and multiply that by 100.

For this position you pay a premium of $487.

This completes the second leg and now you can examine the profit and loss chart for this. As you can see both your max profit and max loss is capped. You gain the max from a rangebound movement of the SPY. If SPY stays between the short strike and long strike then you get the max profit.

And both your max profit and more importantly you max loss is now capped.

There is a iron condor example that I explained in a video on Nvidia stock ( Ticker: NVDA). You may check that out as well. The basic principals remains same only thing is NVDA would not have multiple expiration dates within a week and also individual stocks tend to have higher volatility so the position may require more active management.

Final Thoughts

Overall, Iron Condor is a wonderful strategy to get consistently income from the sideway movement of any stock and ETF. And specifically SPX Iron Condor Strategy make this more attractive because of all the benefit that SPY ETF provides in terms of liquidity and a vast selection of expiration dates.

Hope you gained some value from this article and if you have any further questions around this do put in your comments below or email us at contact@theoptionsuniversity.com.