Options trading can be a powerful tool to grow your small account manifold in a rather short span of time. In this article, my primary focus would be on how to grow a small account with options safely.

I would emphasize the word “safely” here since that is the most important area you need to be aware of in all your trades. If you are not safe in doing options trading, it can easily wipe out your entire portfolio in a few bad trades.

There are multiple safe strategies in options trading that are easy to understand and if you consistently do them over a long period of time, it helps to speed up growing your small portfolio.

So without further ado, let’s get started with it.

Option Pillars

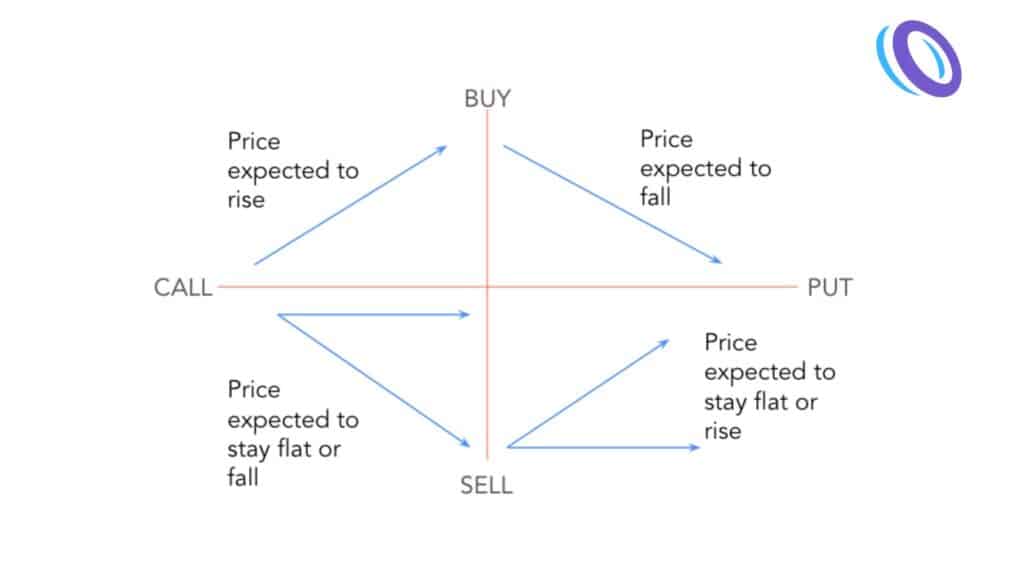

Before we go deep into specific options strategies that can help grow your portfolios let’s take a quick look at the four pillars of options buying. These four pillars form the fundamental of all and any options strategies that you will ever come across. If you have a good solid understanding of them along with Option Greeks then you can master your options skill at any level.

Buy A Call

Buying a call is arguably the first pillar of options trading, and this is how most options traders start their journey. It is best understood as simply getting leverage over your money – you are getting the right to buy 100 shares of a stock at a certain price, known as the strike price, by a certain date called the expiration date.

I hardly ever buy calls, even though I’ve been doing options trading for many years because this is the number one reason a lot of new options traders take risks beyond their portfolio size and get completely wiped out. So unless you are very skilled in technical analysis, I would recommend never buying calls in the options world.

Sell A Call

This is what I would call the second pillar of options – selling a call. I like this more compared to buying a call. Primarily, all the safest strategies that you will find in options are centered around selling calls or selling puts, which we will discuss a little later. The selling part of it is what is considered safer than buying.

Selling a call essentially means you are obligated to sell your hundred shares at a predefined price, known as the strike price, on or before a date called the expiration date. So you have an obligation, not the right, to sell these hundred shares.

Buy A Put

Buying a put is similar in nature and risk-to-reward ratio to buying a call. In buying a put, you are essentially betting on the stock price to go down. By definition, it is a right to sell 100 shares of stock at a strike price on or before an expiration date. Again, I never use this strategy of straight away buying a put and hoping the stock would go down, because there is a high chance of your portfolio getting wiped out very quickly.

I never use this strategy on its own – there are other strategies that use buying puts as one of the legs, which we will discuss when we go to the strategy section. Buying a put forms a basis for some of the more advanced strategies we will discuss later.

Sell A Put

The last one is selling a put. This is the opposite of buying a put. By definition, you are obligated to buy 100 shares of stock at the strike price on or before the expiration date. Again, this is considered safer compared to buying a put, as long as you are not doing a naked put, which is a very risky strategy.

Top Strategies to Grow Small Account

There are many options and strategies that you can use to grow your small account, as I mentioned before. However, not all strategies in options are safe.

For example, there are strategies like straight away buying calls, which is a very dangerous strategy that can wipe out your account very quickly.

There are other strategies, like selling naked calls, which can also wipe out your complete account. Plus, you might get a margin call as well, so you can lose money that you don’t even have – meaning you could lose 100% of your portfolio plus have to put in more money to cover the margin. So there are some very dangerous strategies overall when it comes to options.

But in this particular section, I’m only going to focus on some of the safest strategies in options that you can use to grow your account. My main focus is on some of my favorite strategies that I personally use as well to grow a small account using options.

Cash Secured Puts

The cash-secured put is one of the best strategies to grow your account, although this may require slightly more capital than other strategies that we will discuss later in this section. This is the safest strategy that people use to either generate consistent income or just own the stock at their desired price.

In this strategy, you sell a put at a strike price below the current market price of the stock. By expiration, if the stock does not hit the strike price, you get to keep all the premiums that you collected by selling the puts. If it does hit your strike price, you just own the stock at that price and you always keep the premium in any case.

I have a detailed step-by-step article about cash secured put that you can check out for complete details.

Put Credit Spread

The put credit spread is a very nice strategy to grow your small account. It does not require as much capital compared to the cash secured put that we discussed. It is a spread, so to form this strategy you sell a put which is closer to the money or closer to the stock’s current market price, and then you buy back a put which is further out of the money. This combination makes a put credit spread.

As long as your stock stays above your shortest strike price, you get to collect the complete premium. The return on investment in this particular strategy is very high because you are only putting up collateral which is the difference of the strike prices multiplied by 100, and you collect a premium which would be almost 8 to 10% of your invested capital. So this is a fantastic strategy to grow a small account.

Call Credit Spread

The call credit spread is kind of the exact opposite of the put credit spread in some ways. You do a similar setup but it’s on the call side of the options. To form this strategy, you sell a call that is closer to the money or closer to the stock’s current price, and then you buy a call that is further out of the money. This creates a call credit spread.

You collect the premium to open this position, and as long as the stock stays below your short call, you get to collect the complete premium. This is again a wonderful strategy in terms of risk-to-reward profile, because you are only risking a certain amount of collateral and your max loss is capped, while your return on investment is pretty high.

Call Debit Spread

The call debit spread is the reverse of a call credit spread. In this strategy, you sell a call that is further out from the current stock price, and then you buy a call that is closer to the current stock price.

This forms a call debit spread. In this strategy, you actually pay an amount to get into the position. As long as the stock moves above your buy strike, you benefit from the upside potential of the stock. However, your max gain is capped because you are selling a call that is farther out of the money.

This is again a good strategy if you want to make money from the upside movement of a stock but you do not have much capital to open, for example, a LEAP option, or you do not have full capital to outright buy the stock. This is a good strategy for small accounts to benefit from the upside potential of a stock.

Iron Condor

An iron condor is a combination of a put credit spread and a call credit spread. If you combine these two strategies together, that is what is called an iron condor.

In this strategy, you basically make the most money if the stock moves between the two strike prices that you have selected on the call side and the put side.

If the stock moves between these two prices, then you get to benefit the most, and the stock has to be in a sideways movement for this strategy to play out to its full potential.

Iron Condor may not be for a complete beginner because it requires a total of four leg options positions to be opened at one time. If it moves in an unexpected direction, it may be tricky to adjust the position. However, once you get the hang of this strategy, it is a wonderful way to grow your account very quickly.

Also Read

Avoid Rookie Mistakes

As a beginner with a small account, it is of utmost importance to avoid some of the rookie mistakes that many new options trader does which completely wipes their portfolio out. I am going to list some of the common mistakes in this section and if you can avoid them I am sure you would have a much better chance of success in your options trading journey.

The first mistake that a beginner options trader makes is overleveraging. Fundamentally, options provide leverage but that does not mean you should go all in on any particular option.

You may have heard some stock being hyped and talked about a lot on YouTube or other social media, and then you just go and straight away buy a call expiring in a week, expecting your returns to go multi-fold. That is the number one mistake a lot of options traders make, and you should not over-leverage at any point in time.

The first mistake that a beginner options trader makes is overleveraging. Fundamentally, options provide leverage but that does not mean you should go all in on any particular option.

You may have heard some stock being hyped and talked about a lot on YouTube or other social media, and then you just go and straight away buy a call expiring in a week, expecting your returns to go multi-fold. That is the number one mistake a lot of options traders make, and you should not over-leverage at any point in time.

The first mistake that a beginner options trader makes is overleveraging. Fundamentally, options provide leverage but that does not mean you should go all in on any particular option.

You may have heard some stock being hyped and talked about a lot on YouTube or other social media, and then you just go and straight away buy a call expiring in a week, expecting your returns to go multi-fold. That is the number one mistake a lot of options traders make, and you should not over-leverage at any point in time.

Final Thoughts

To conclude, I would say it is very much possible to grow a small account using different options strategies safely, and anyone with a good knowledge of options can do this. The more important factor would be avoiding the common mistakes that beginners make, which we discussed. If you are successful in avoiding those mistakes, then you can be successful in multiplying your account size very quickly.

Not every trade will go in your favor always, so as long as you keep your overall winning percentage higher than your losing trades across your portfolio, your portfolio will grow over time using these options strategies.

The key takeaway on how to grow a small account with options lies in managing risk, avoiding overleveraging, planning trades carefully, and cutting losses when needed. With education and discipline, options trading can safely grow small accounts.