There are many stocks and ETFs that you can run a wheel strategy on. However, based on my options trading experience I have found these five that are the best stocks for wheel strategy.

And that is exactly what we are going to discuss in this article.

The Wheel Strategy – Brief Overview

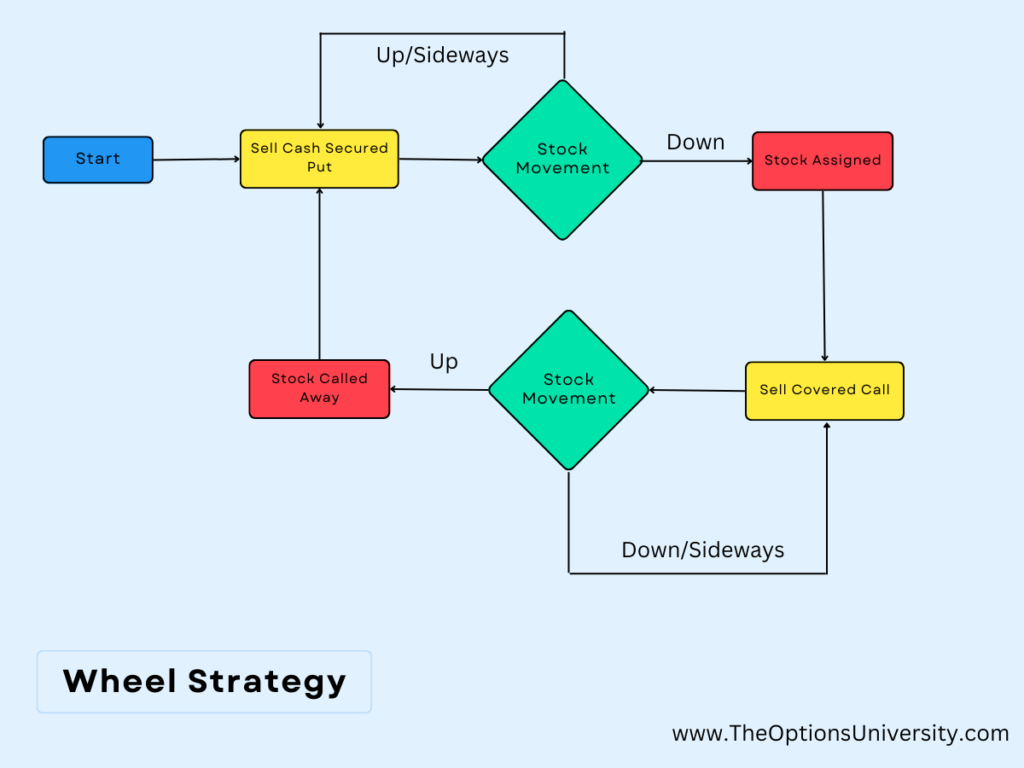

Wheel strategy is one of the safest strategies you can find in the market. This primarily involves 2 legs: selling cash-secured puts (CSP) and selling covered calls ( CC). It starts with the first leg of selling a cash-secured put on a stock that you want to own at a certain price.

You then keep selling puts until assigned and once assigned you then start selling covered calls against the same stock until it gets called away. That completes a full circle and you start again from the beginning by selling puts. In all of this, you collect a premium at every step plus any capital gain on the stock that you get when your stocks are called away.

You can get more detail on the wheel strategy in this article.

In case you are completely new to options trading then I would highly recommend that you first go through our article Options 101 – A Beginners Guide. That will give you the ins and outs of the options trading.

In this article, I will be going through five of the best stocks and funds to run a profitable wheel.

Best Underlyings For Wheel Strategy 2023

SPY

The SPDR S&P 500 trust is an exchange-traded fund that trades on the NY stock exchange under the symbol (SPY). SPDR is an acronym for the Standard & Poor’s Depositary Receipts the former name of the ETF. It is designed to track the S&P 500 stock market index. This fund is the largest and oldest ETF in the world.

Also Read: Generate Monthly Rent Using SPY Wheel Strategy

There are a lot of traits that SPY satisfies to run a successful wheel strategy. Let’s look at those factors:

Pros

High Liquidity: SPY is probably the highly traded ETF on the NY stock exchange, making it a perfect candidate for the wheel.

Low Volatility: SPY has lower volatility so it doesn’t make wild swings unless there is a major economic or other events that impact the wider market. Having low volatility makes SPY ideal for wheel strategy.

Expiration days: SPY has multiple expiration dates in a single week, unlike any other stocks/funds which typically have weekly/monthly options only.

Cons

Low Premiums: This is an inverse effect of having low volatility. SPY does not fall into the high-swing ETFs, so it tends to provide low premiums.

QQQ

Invesco QQQ is an exchange-traded fund (ETF) that tracks the Nasdaq-100 Index™. The Index includes the 100 largest non-financial companies listed on the Nasdaq based on market cap. Based on daily traded volume, QQQ is the second-largest fund in the United States.

Pros

High Liquidity: Similar to SPY, QQQ is also one of the highly traded funds on the NY stock exchange, making it a perfect candidate for the wheel.

Growth: QQQ tracks the top 100 tech companies that primarily operate out of the US and that makes it really attractive to take advantage of growth while leveraging the wheel strategy.

Cons

Tech Heavy: QQQ comprises all companies in the tech sector and that makes it slightly speculative and pronto higher swings.

Volatility: QQQ is of medium volatility hence you can expect a slight bit of swings but compared to individual stocks this is still a better choice for running the wheel.

TNA

Pros

Huge Premiums: TNA gives one of the best bucks for your money in terms of premiums. This is a good instrument to leverage yourself rather safely by keeping a small percentage allocated to this.

High Volume: TNA is also one of the most traded funds in the stock market so you will not have issues closing or rolling off your options if they don’t go in your favor.

Cons

3X Leverage/High Risk: As mentioned earlier this is a leveraged ETF and can go down significantly in fund value during market drops. It magnifies your losses so wheel this weekly with a small % of your overall portfolio.

TNA falls into the high-risk and high-reward categories. This index fund measures the performance of approximately 2,000 small-capitalization companies in the Russell 3000® Index, based on a combination of their market capitalization.

The fund invests at least 80% of its net assets in financial instruments, such as swap agreements, securities of the index, and ETFs that track the index and other financial instruments that provide daily leveraged exposure to the index or ETFs that track the index.

This is a 3X leveraged index so there is an inherent risk of owning this fund and it is only meant to hold for a small period of time. The Options Greeks on 3X leveraged stock make the price action significantly volatile compared to a regular stock/eft price action. Do not plan to hold this in your portfolio as a long-term fund. Do your research about 3X leveraged risk before planning on investing in any of the leveraged funds.

TQQQ

Pros

Huge Premiums: TQQQ again will give you one of the best bucks for your money in terms of premiums. This is a good instrument to leverage yourself rather safely by keeping a small percentage allocated to this.

High Volume: TQQQ is also one of the most traded funds in the stock market so you will not have issues closing or rolling off your options if they don’t go in your favor.

Cons

3X Leverage/High Risk: As mentioned earlier this is a leveraged ETF and can go down significantly in fund value during market drops. It magnifies your losses so wheel this weekly with a small % of your overall portfolio.

TQQQ also falls into the high-risk and high-reward categories. This leveraged ProShares ETF seeks a return that is 3x the return of its underlying benchmark (target) for a single day, as measured from one NAV calculation to the next.

The underlying benchmark target here is the Nasdaq 100 which primarily is made of the top 100 companies listed in NASDAQ by their market capitalization.

Also Read

This is a 3X leveraged index so there is an inherent risk of owning this fund and it is only meant to hold for a small period of time. Do not plan to hold this in your portfolio as a long-term fund. Do your research about 3X leveraged risk before planning on investing in any of the leveraged funds.

GOOG

Google is one of the top 5 companies that probably every fund worldwide has exposure to. It has a robust pipeline of revenue and is well diversified. Google has shown the best track record in terms of being a stable stock throughout the COVID and post-COVID recession fears.

The medium volatility and strong fundamentals make it one of the best stock-for-wheel strategies that you can play for the long term.

Pros

Strong fundamentals: Google is a great combination of having growth and strong fundamentals. It gives you a solid amount of growth without putting your money into a speculative stock.

Volatility: Google has medium volatility and in most market conditions it will go in a range-bound fashion which makes it a great fit for wheel strategy.

High Liquidity: Google is traded widely in major exchanges and that makes it very liquid in nature. You will not find any issues closing or rolling off the options.

Cons

Medium Premiums: You cannot expect very high premiums however it would be better than some of the other stable stocks in the market.

Legal: Since the tech sector, in general, is subjected to some legal battles. If there is any lawsuit filed against Google that may temporarily impact the prices. Large swings may be seen during any company-specific news.

FAQ

Best stocks for wheel strategy include index funds with good volume like SPY, QQQ, TNA, and TQQQ. Some other recommended stocks for wheel strategy are Amazon ( AMZN) and Google ( GOOGL).

Yes, the wheel strategy is profitable. It is considered one of the safest strategies in the stock market that are bound to give consistent weekly/monthly income provided the right underlying are chosen.

Yes, the wheel option strategy is considered one of the safest option strategies. A lot of people run wheel on stock to generate a consistent monthly income.

You can start the wheel strategy with as low as $2000. You can always increase the amount as you start to generate weekly profit.

Both are considered different investment strategies. Wheel strategy can make you consistent income weekly or monthly depending on how you set it up. In comparison, the buy-and-hold strategy will not give any income until you sell your stocks.

Yes, With its low-risk nature and the ability to generate income on both sides of the stock, this strategy offers a compelling option for those looking to maximize their returns.

Wheel strategy works irrespective of whether the stock goes down or up.

QQQ is an ETF managed by Invesco which tracks the movement of the Nasdaq 100. It is one of the popular derivatives that you can execute wheel strategy on.

The steps include selling puts on QQQ until you get assigned and then selling covered calls until it is called away. After that, you simply rinse and repeat the same. This is called running a wheel strategy on QQQ.

Yes SPY is perfect for options trading. SPY is one of the highly traded underlying in US market. It is highly liquid with several options expiration dates and these traits makes it a perfect candidate for doing any strategies around options trading.

Final Words

So there were my picks of the best stocks for wheel strategy. Wheel strategy is one of the best strategies out there to generate consistent income. However not every stock and ETF is well suited for this strategy. So do checkout for the pros and cons carefully and make your decision wisely when starting out a wheel on any stock/ETFs.

Hope you liked this article and if you have any questions do leave your comments or you can email at contact@theoptionsuniversity.com.