In this article, I am going to explain how to run a successful SPY Wheel Strategy. I will be using Robinhood as a platform as that is very user-friendly in my view to run different types of options strategy. However, the principles remain the same and you may use any of the brokers of your choice.

The wheel strategy is considered one of the lowest risky and consistently profitable strategies in the stock market. Many big investors use this strategy to generate a consistent weekly/monthly income from the market irrespective of market directions.

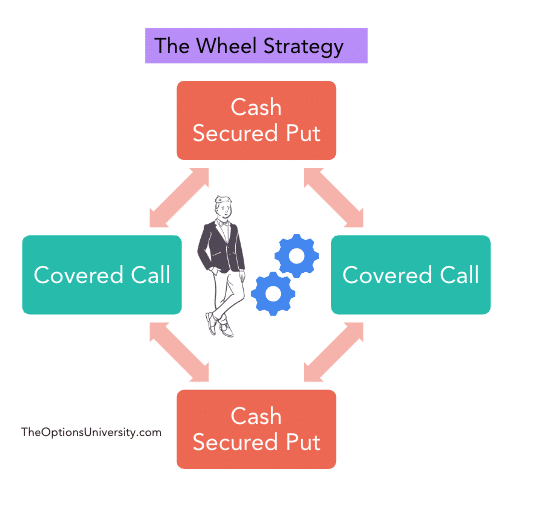

The Wheel strategy combines two options strategies together a cash-secured put and a covered call.

The first step or leg of the wheel starts with selling a cash-secured put until the stocks are assigned. And then the second step is to sell a covered call against those assigned stocks until they are called away.

And the wheel continues back from the first step. If all these sounds confusing then do not worry we are going to take the example of the ETF SPY.

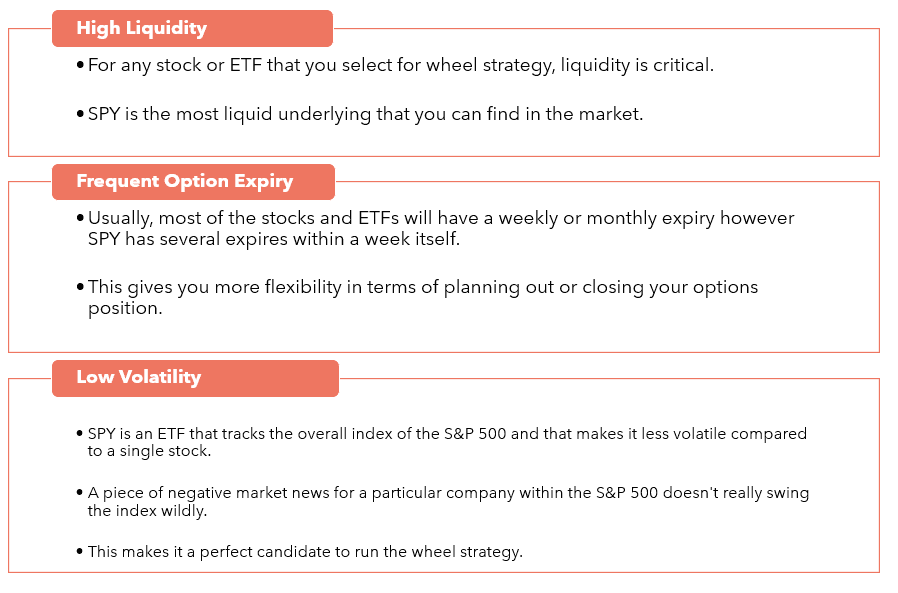

SPY is one of the popular ETFs in the US market that tracks the movement of the S&P 500. Below are the top three attributes that make it an ideal candidate to run the wheel strategy.

SPY Wheel Strategy Options

Okay so now let’s take an example of how to run the SPY wheel strategy on spy ETF. We are going to take again Robinhood as our broker platform as this is one of the platforms that I personally use.

I would recommend anyone starting with options trading to also go with Robinhood because it’s very much easy to kind of close your option rollout and option or execute any anything of the option strategies.

Leg 1: Cash Secured Put

Now as we mentioned the first step in a SPY wheel strategy is selling cash security put, here why we call this cash secured because we are putting our money as collateral to sell puts.

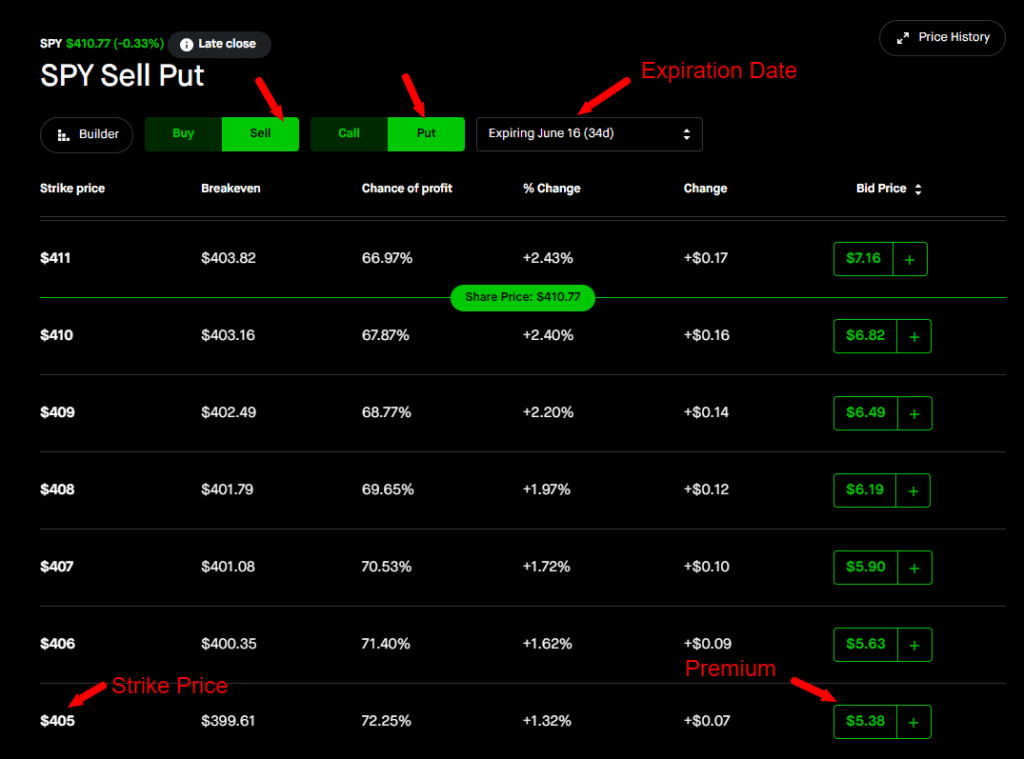

You select the Sell and Put option from the top as shown in the screenshot below and then select a strike price below the current market price/spot price.

The lower you go the more winning chances you will have that it will not expire In the money.

So SPY is currently trading at approximately $410 and we have selected $405 as our strike price with an expiration date of June 16th which is 1 month out from today.

This gives us a premium of $538 which we would instantly receive on our brokerage account.

Now there are only 3 scenarios that can happen at the expiry of June 16th.

- SPY stays above the strike price of $405

- SPY stays flat at the strike price of $405

- SPY goes below the strike price of $405

And here’s is how our profit/loss would look like in each of these cases:

| SN# | Scenario | Profit / Loss |

| 1 | SPY @ Expiry > $405 | Profit: Net Premium Received – $538 |

| 2 | SPY @ Expiry = $405 | Profit: Net Premium Received – $538 |

| 3 | SPY @ Expiry <$405 | Loss: Value of 100 shares of SPY – Premium Received $39,962 ($40,500 – $538) |

So let’s understand the profit and loss in this scenario in slightly more detail so that it hopefully becomes completely clear.

In the first case where your SPY spot price on June 16th ended up being more than your strike price which was $405 in this case, it is very clear that because it ended up being more than your strike price you get to keep the complete premium and your collateral money is also released so you are in profit in this case.

Now let’s take the second case this is also very similar to the first one because SPY ended up exactly the same as your strike price the option you get to keep the premium and the collateral money is released.

The third case is where I would like to go into a bit more detail because you will incur a loss ( Technically it is not a realized loss ). We will get to that point just a little later.

In this case, the SPY goes below your strike price of $405 so as a put seller you are obligated to now buy the SPY stock at $405 even though the market price is less than $405. Technically the collateral money is not lost here it is just that you are being assigned 100 shares of SPY stock at a higher price than the market price.

For case#1 and case#2 since the collateral money is now released you can again do the cash secured put for a future expiry date and collect the premium.

If you end up on case#3 then you do the next leg of the wheel strategy which is selling a covered call.

Leg 2: Covered Call

The second leg of the SPY wheel strategy is selling a covered call against 100 shares of SPY that you were get assigned because of case#3.

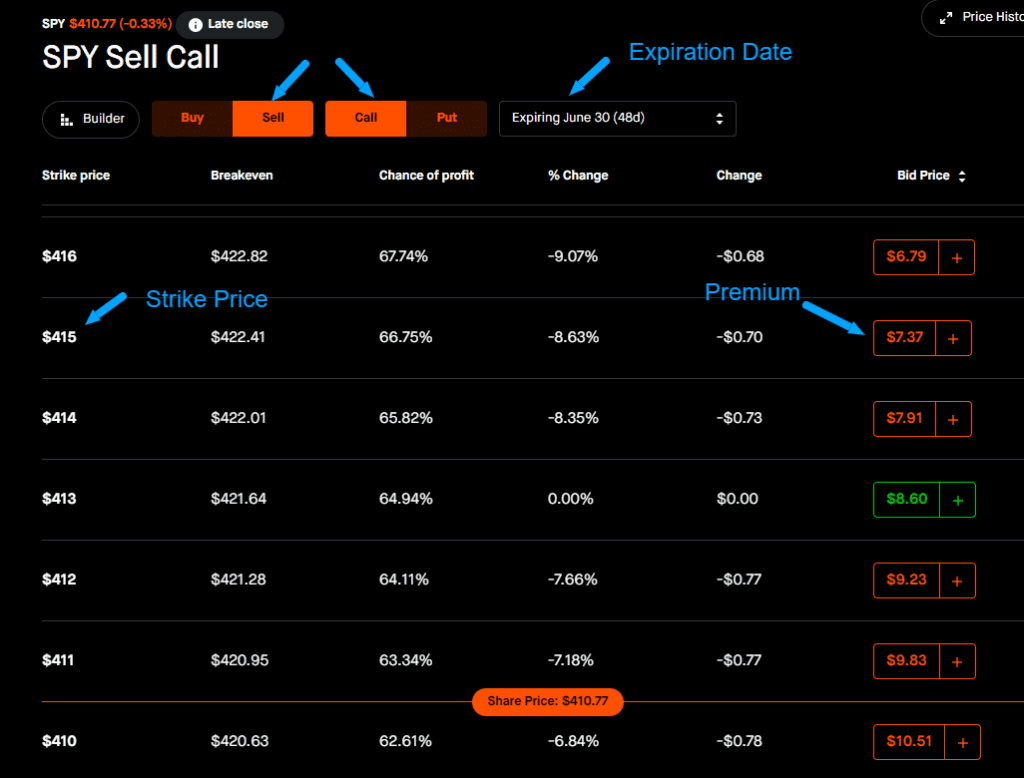

You would select Sell and Call with an expiration date in the future ( June 30th). Remember the previous expiry was June 16th so we are selecting anything beyond that.

The strike price you choose is slightly Out of the Money ( OTM) for example we select a strike price of $415 and get a premium of $737 for doing so.

Similar to the cash-secured put strategy there are only 3 possibilities that can occur in this case as well.

- SPY stays below the strike price of $415

- SPY stays flat at the strike price of $415

- SPY move past the strike price of $415

Here is what the profit and loss chart would look like in all these three cases.

| SN# | Scenario | Profit / Loss |

| 1 | SPY @ Expiry < $415 | Profit: Premium Received – $737 |

| 2 | SPY@ Expiry = $415 | Profit: Premium Received – $737 |

| 3 | SPY @ Expiry > $415 | Loss: 100 shares of SPY sold @ 415 |

So let’s understand the profit and loss in this scenario in slightly more detail so that it hopefully becomes completely clear.

In the first case where your SPY spot price on June 30th ended up being less than your strike price which was $415 in this case, it is very clear that because it ended up being less than your strike price you get to keep the complete premium and your SPY stocks as well.

Now let’s take the second case this is also very similar to the first one because SPY ended up exactly the same as your strike price the option you get to keep both the premium and the stocks.

In the third case since the SPY goes beyond the strike price, you as a seller are obliged to sell 100 shares of SPY at $415 no matter how high the current SPY price is so you will technically have an unrealized loss.

For example, if SPY goes to $420 on expiry you are forced to sell the stocks at $415 only so will have missed the opportunity of making a profit of $500 (The difference between the strike price and current market price multiplied by 100).

For case#1 and case#2 since you still own 100 shares of SPY you can again do the covered call for a future expiry date and collect the premium. That would repeat until you end up on case#3.

If you end up on case#3 then you again start from step 1 of selling cash-secured puts and the wheel continues.

FAQ

Wheel strategy in itself is considered one of the safest strategies in options trading and doing it with an index ETF like SPY makes it almost risk-free. However, winning the SPY wheel strategy hinges on two critical aspects first you choose the right strike price on both ends and second be up to date on any sudden market moves and adjust position accordingly.

SPY is an exchange-traded fund from SPDR and as opposed to a stock the frequency of any ETF split is low. SPY does not split as often as some of the other derivatives do. The last split occurred for SPY on October 16, 2017.

Final Thoughts

Wheel Strategy on SPY is one of the safest option strategies that you would find in market. As you can see there is very little risk involved and you can literally pay your rent or consider this investment almost equivalent to a real estate investment that consistently generates you income every month.

And the best part is you do not need that much capital compared to a real estate investment and it is completely liquid unlike any real estate investments.

Hope this has clarified how to run a wheel strategy on SPY. If you have any questions regarding this you can always comment below or send your questions at contact@theoptionsuniversity.com