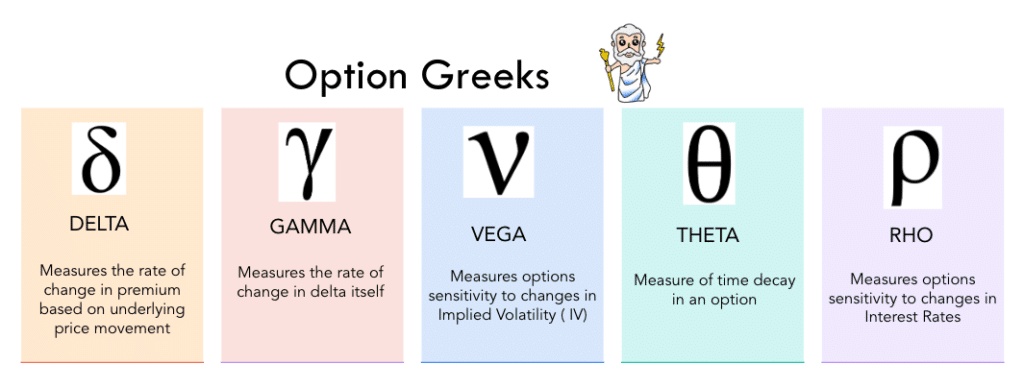

Option Greeks essentially determine how an option premium is going to perform relative to the changes in underlying price as well as a lot of other factors like volatility and time duration.

There are five major Option Greeks that impact the premium price for an option, they all vary and control different factors for the option. Apart from these, there are other minor Greeks as well but they do not have any severe factors in the premium so we will leave them out for our discussions here.

If you are a complete beginner to the option trading then I would first recommend you to check out this article which explains the options trading for beginners.

Here’s a quick overview and definition for each of them.

You may think of these option Greeks as different agents in a science lab, you try to mix and match them to get that perfect balance in the final solution.

Now take that analogy to the stock market, in a very similar way, using option Greeks you can control the risk you would like to take or reducing reduce your exposure to certain market environments.

So without further ado let’s dive deeper into each of these Greeks.

Option Greeks – Delta

An option delta is a directional exposure for an option. To simplify let’s say the delta of an option is 0.5 and if the stock moves up by $1 then the option premium goes up by 50 cents and if the stock goes up by $10 then the option premium would go up by $5 ( 10 * 0.5).

So essentially delta tells us the expected price change in option premium depending on a one-dollar change in stock price.

In every option chain, you can find these Greeks for every strike price and expiration date. The values for these Greeks vary depending on what strike price and expiration date you select. It also varies based on the options strategies. As for a buy call option greeks value would be different than a buy put option. We will go into more detail on that in a dedicated Delta article.

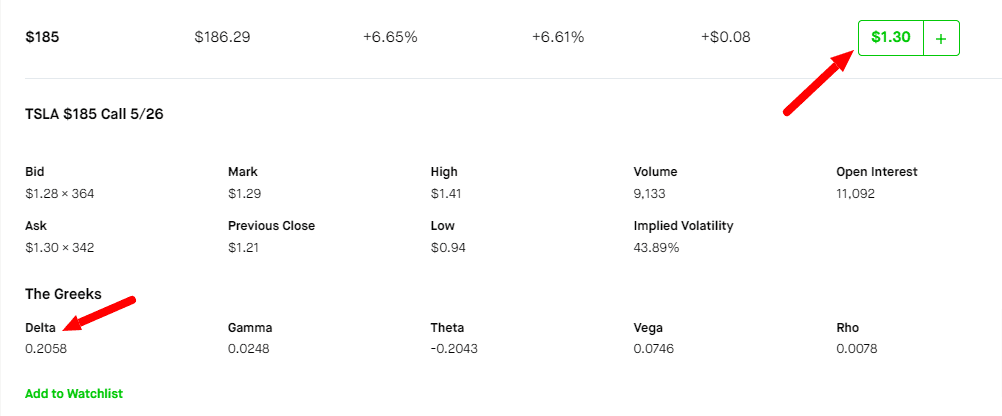

For now, let’s keep it simple and understand how the delta really impacts the option premium. Below is an example from Robinhood buy call option chain of Tesla stock with a strike price of $185 expiry on 05/26.

In this, you can see that the delta is .2058 and that means that a $1 move in Tesla price will move the option premium by 20 cents. Notice the premium currently is $130.

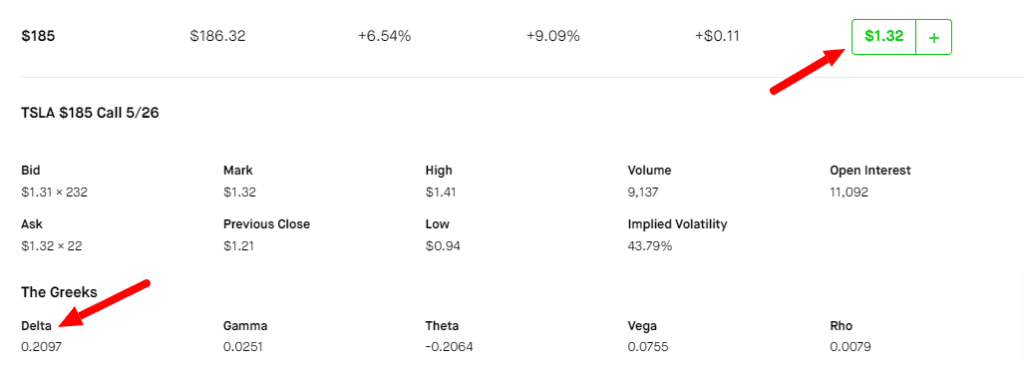

And below is a screenshot taken just 5 minutes after the first one and the delta has moved slightly to .2097 and that has in turn moved the premium up by $2 to $132.

Option Greeks – Gamma

Gamma simply dictates the movement of Delta. For a $1 move in the stock price how much Delta should move is dictated by the Gamma greek.

So taking the previous example of Tesla the movement of Delta from .2058 to .2097 is decided by the Gamma. It is basically a measure of the sensitivity of the option so a higher Gamma would mean that option is more sensitive to the changes in the stock price as the delta would see a more rapid movement.

Gamma is an important Greek however it is best that as a normal retail trader, we don’t focus too much attention on the gamma movement. Personally, I would focus more on the Delta which have discussed, and Theta which we will be covering next for my decision-making.

Option Greeks – Vega

Vega measures the risk of changes because of Implied volatility ( IV) also known as the forward-looking expected volatility in the underlying price.

In simple terms, Vega directly correlates to how volatile a stock option movement is expected to be in forward-looking prospects. The higher the volatility the higher vega and that means a higher premium.

A great example of this is the earnings season, if there is an earning coming in for stock next week you will notice a higher vega value and higher premium prices for options that have expiration falling in that earnings week.

And right after the earnings the volatility goes down and so are the premium prices. This is popularly known as the IV crush. There are dedicated option strategies that you can execute to take advantage of the IV crush.

The vega plays an important role in identifying the volatility of a particular stock. So in general you would see a higher vega on small-cap stocks or stocks with very low liquidity. These types of stocks should be avoided by an option trader as much as possible since they tend to have a high bid-ask price which represents a lot of challenges in closing or rolling over your option position.

Apart from these special scenarios usually Vega wouldn’t move that much for a shorter duration expiration like weekly or monthly so unless you are looking at Leap options which are far out in the future the Vega doesn’t play that crucial role in the short term since usually you wouldn’t expect a stock to move 20-30% in a week.

Option Greeks – Theta

Theta is one of the most crucial greek to understand if you want to nail the option trading especially if you want to win the trade 90% of the time.

Theta measures the rate of time decay in the value of the option premium. If you are a beginner options trader then a very simple phrase that you should relate theta to is “Time is Money”.

Let’s take a real-world example, suppose there are two friends who are preparing for SAT or any other competitive exam however, there is a key difference they both have exams on different dates in the future. One of them has an exam next week vs the other has an exam three months down the line. Who do you think has a better chance to clear the exam? The answer is very obvious right the one who has more time to prepare.

The same principle applies to the options as well, the more time you have the more chances you will have to be on the winning side. For example, if a stock is trading at $100 now and you buy a call option with a strike price of $110 with an expiration date of next week vs if you buy the same call but with an expiration date that is one month from now. You will obviously have more chances of stock going above your strike price in a month compared to a week.

And that is why the price you pay to buy the call option will be very different in both those cases. You will pay a much higher premium for an option that has an expiration date a month from now vs the one expiring next week. And as an option seller, you get to keep that premium.

Personally, I love theta and this is one of the most important Option Greeks apart from the delta that I would always look for when executing any option strategy.

Theta value tends to accelerate when the option is near expiry and that is very good as an option seller especially if you are a weekly option seller. I am mostly an option seller and I use the theta to my advantage because if the option doesn’t hit the strike price at the expiry the option expires worthless and as a seller of the option you get to keep all the premium. And that is what I love about option selling.

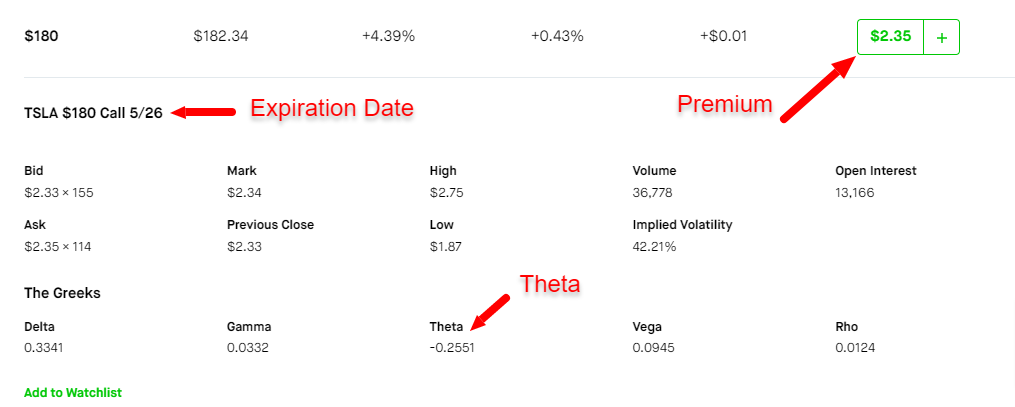

Let’s take a quick example of Tesla again. Below is a call option for Tesla that’s expiring on 05/26. If you buy this call option you will have to pay a premium of $235 ( $2.35 x 100)

The Theta value for this option is -0.2551 what this means is that this option will lose $25.51 ( .2551×100) with each passing day so tomorrow the option will be less than today and so on.

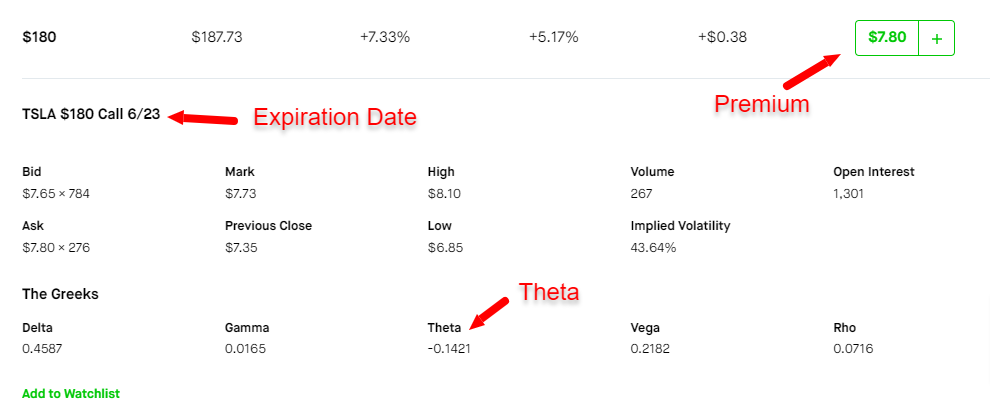

Now take the below example. This is the same call strike option but with an expiration date that is about a month out. If you notice that the premium as an option buyer you have to pay is $780 which is almost $500 more than the previous one.

And the main contributing factor for the price of this premium is the Time and Theta here determines the exact value for that time. So Theta basically puts a price tag on the time.

Also, notice that Theta here is less compared to the previous one and that is because there is a lot of time left for this option to get expired.

Option Greeks – Rho

Rho captures the interest rate sensitivity. It factors in the interest rate changes into the option premium. And since interest rate does not change very often and even if they do they would not see a sudden jump in a percentage point.

So as an options trader unless you are into bond investing you can ignore the Rho completely for your most option strategies.

Personally, I have never really looked at the Rho value in an option as this has very little and ineligible impact on the option.

Final Thoughts

Overall, option Greeks are the levers that you pull and adjust in an option trade to get the right balance for whatever option strategy you are planning to execute. All the option greeks are important however, out of all of them the two most important ones that you should put more focus on are Delta and Theta. If you can master these two option greeks you will become a much better option trader.